After Thursday’s US consumer price index (CPI) reading, the lowest recorded in a year, investors increased their bets that the Federal Reserve will reduce its rate hike from 50 basis points in December to 25 basis points at its next meeting on February 1, 2023. At the time of writing, the CME FedWatch Tool showed 95% probability of a 25 basis point rate hike in February, which will bring the target range of the federal funds rate to 4.50% – 4.75%.

According to the data published by the US Bureau of Labor Statistics, the annual US headline inflation eased for six consecutive months to 6.5% in December 2022. However, the labor market is still showing signs of strengths, it added 223K nonfarm payrolls in December 2022, beating market forecasts of 200K.

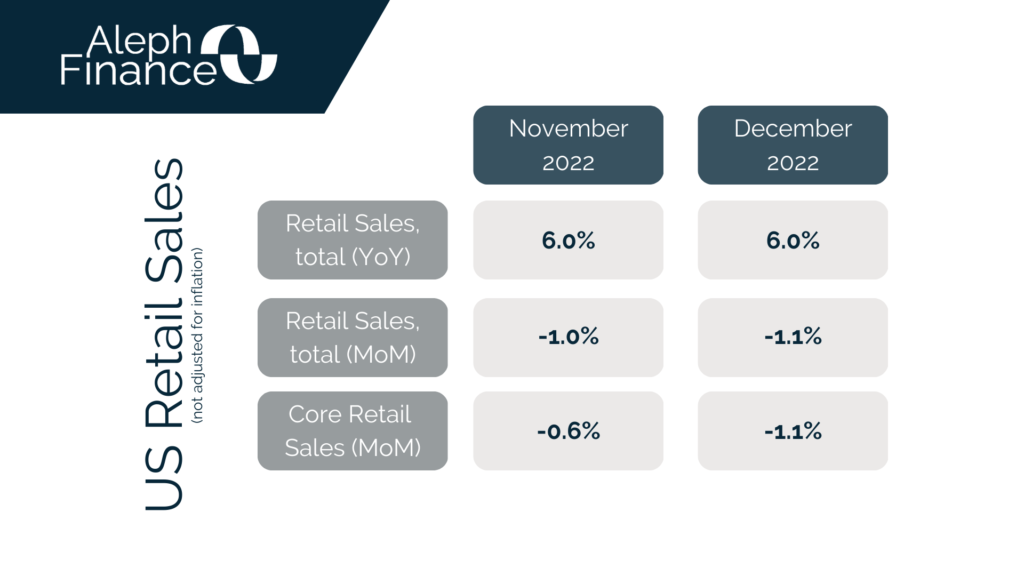

Confirming the downsizing of inflationary pressure, both the annual headline and core US Producer Price Index (PPI) data were below market forecasts. Also, US retail sales came weaker than market expectations. According to the US Census Bureau, retail sales in December 2022 declined 1.1% month-over-month, from an upwardly revised decrease of 1.0% in November. Year-over-year retail sales were 6.0% in December 2022, the same as the downwardly revised data for November. All eyes are now on the Fed’s next monetary policy meeting.