Last week, Dec. retail sales data showed that spending decreased significantly as 2022 came to an end. Housing market is already in recession and it seems that manufacturing is joining it. Labor market, on the other hand, remains robust.

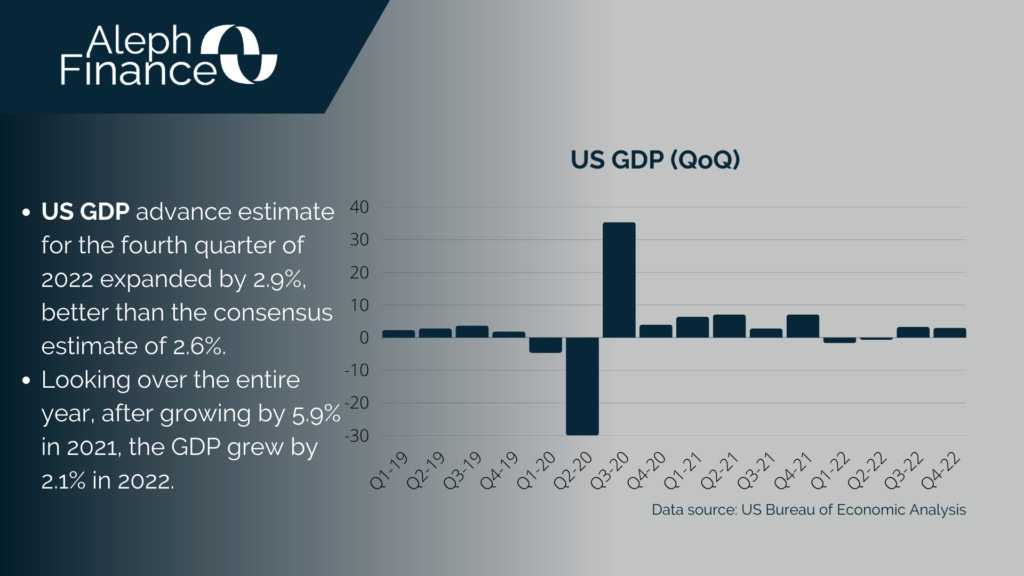

The Federal Reserve Board will meet next week and there is a strong market expectation for a 25 basis points rate hike. The focus today was on the release of the US GDP data that is one of the parameters closely watched by the central bank. The Atlanta Fed’s GDPNow tool estimated an expansion of 3.5% in the last three months of 2022, while the consensus was 2.6%.

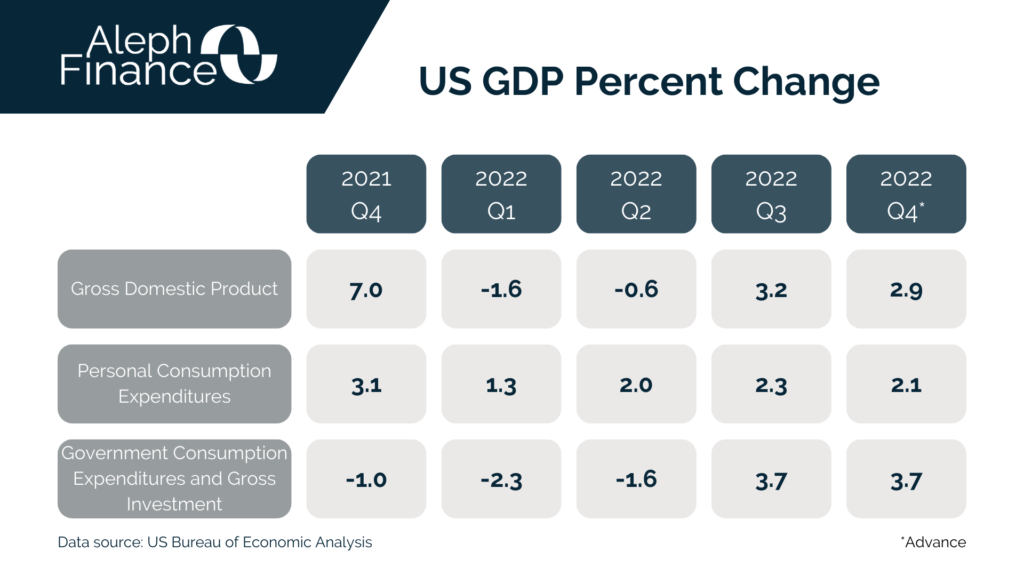

According to the US Bureau of Economic Analysis, US GDP Advance for the fourth quarter of 2022 expanded by 2.9%, following an annualized growth of 3.2% in the third quarter of 2022. Data published was better than the consensus estimate. Consumer spending rose 2.1% in Q4, below 2.3% in Q3. Looking over the entire year, after growing by 5.9% in 2021, the GDP grew by 2.1% in 2022.

S&P 500 futures rose a bit after the fourth quarter GDP came out better-than-expected.