On the macro front, this week’s main focus is on US inflation, the last Consumer Price Index data before the first Federal Reserve meeting of 2023 on January 31-February 1.

Prior the release of the data, Fed members Mary Daly and Raphael Bostic stated on Monday on separate events that they expect an interest rate hike of more than 5% before halting for some time. Fed Chair Powell said on Tuesday during a speech at Sveriges Riksbank that the central bank may have to make unpopular decisions to restore price stability. The Fed slowed the pace of its rate increase at its December meeting (+50 bps after four consecutive increases of + 75 bps). The question now is whether the Fed will raise the funds rate by +50 bps or slow the pace further to +25 bps at its next meeting. The CME FedWatch Tool shows a higher probability for the latter. The labor market continues to be strong with an employment rate of 3.5% and 223K added nonfarm payrolls in December 2022.

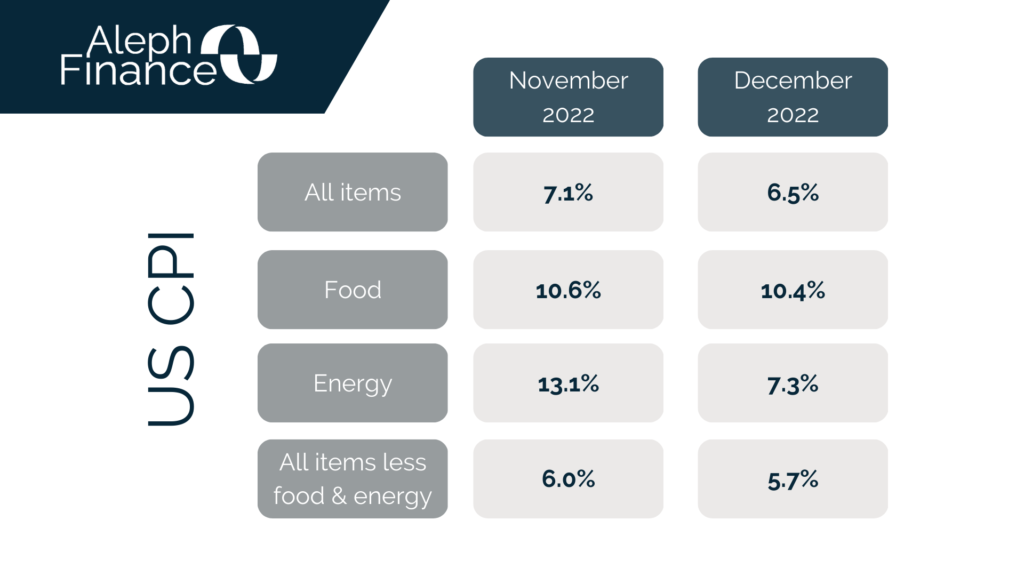

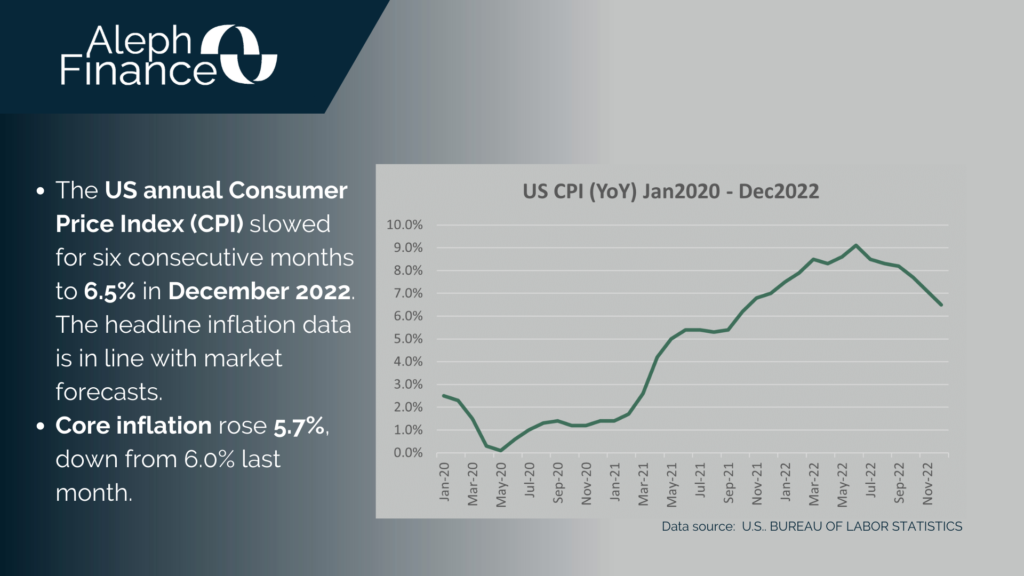

Both the US headline and core inflation data came out in line with market expectations. According to the US Bureau of Labor Statistics, the CPI slowed to 6.5% year-over-year in December 2022, the lowest since October 2021. Core CPI also eased to 5.7% in December 2022, from 6.0% the prior month.

After the release of the Dec. CPI, Fed’s Harker (Philadelphia Fed President) said 25 hikes “will be appropriate going forward”.

In general, positive reaction at first glance by the financial markets.