The Federal Reserve increased the funds rate by 25 basis points at the first FOMC meeting of 2023. It follows a half a percentage point increase in December, making it the smallest increase since the central bank started raising rates last March. This interest rate hike of a quarter-point was highly expected. In fact, the CME FedWatch Tool indicated a very high probability of such an increase.

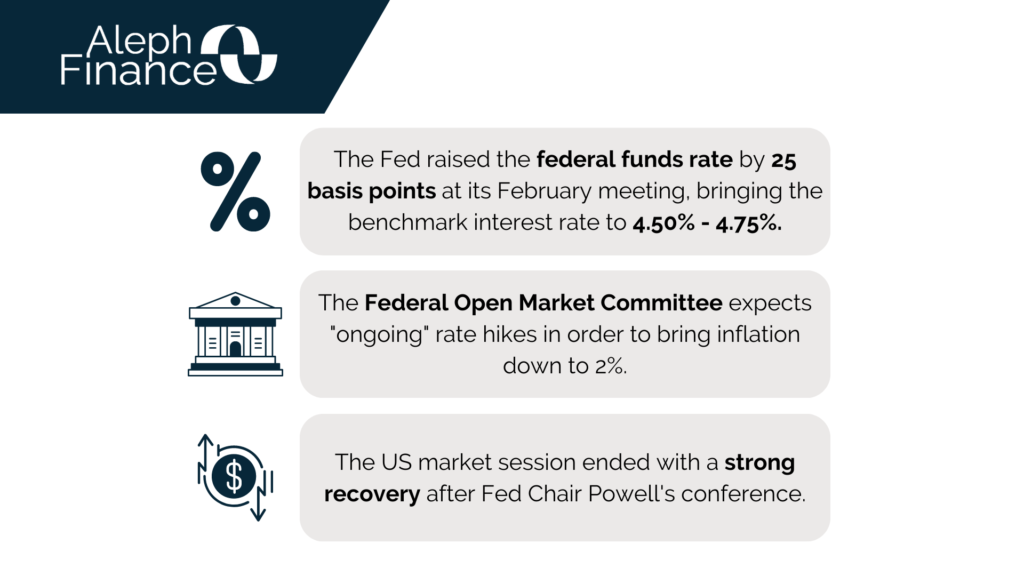

The fed funds rate range is now at 4.50% – 4.75%, the highest since 2007. The decision came after encouraging inflation data and a slowing labor cost. The latest US CPI from the US Bureau of Labor Statistics showed that inflation slowed for six consecutive months to 6.5% in December 2022, from 7.1% in November. The employment cost index rose 1% in Q4, less than the forecast of 1.1%.

Close attention was given to Fed Chair Powell’s comments to understand whether the Fed intends to confirm its intention to raise the federal funds rate above 5%.

“Shifting to a slower pace will better allow the Committee to assess the economy’s progress toward our goals as we determine the extent of future increases that will be required to attain a sufficiently restrictive stance” said Fed Chair Powell. During the press conference, Powell also reiterated their strong commitment to bring inflation down to their 2% target and that they expect “ongoing” rate hikes.

The US market session ended with a strong recovery after Fed Chair Powell’s conference.