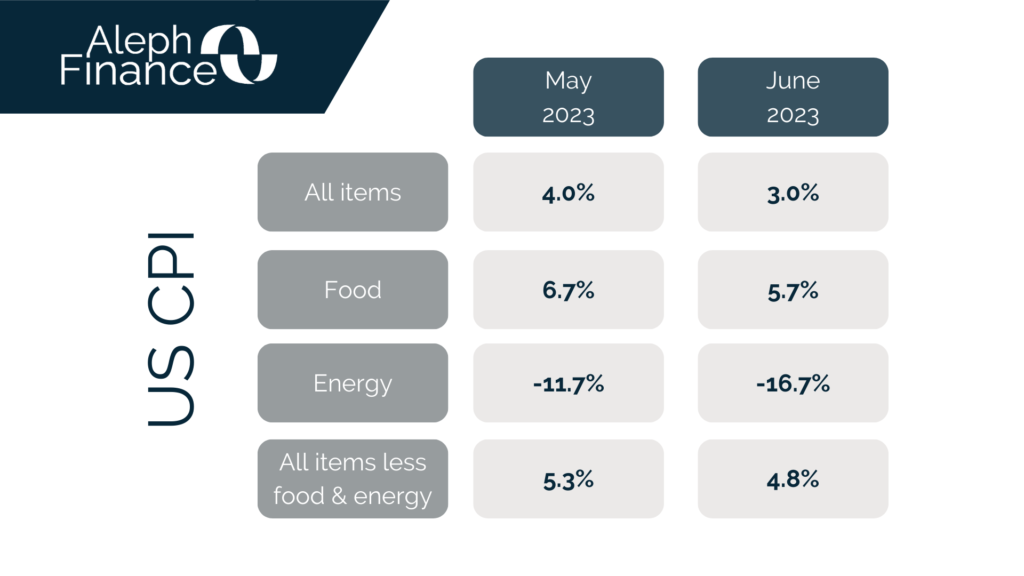

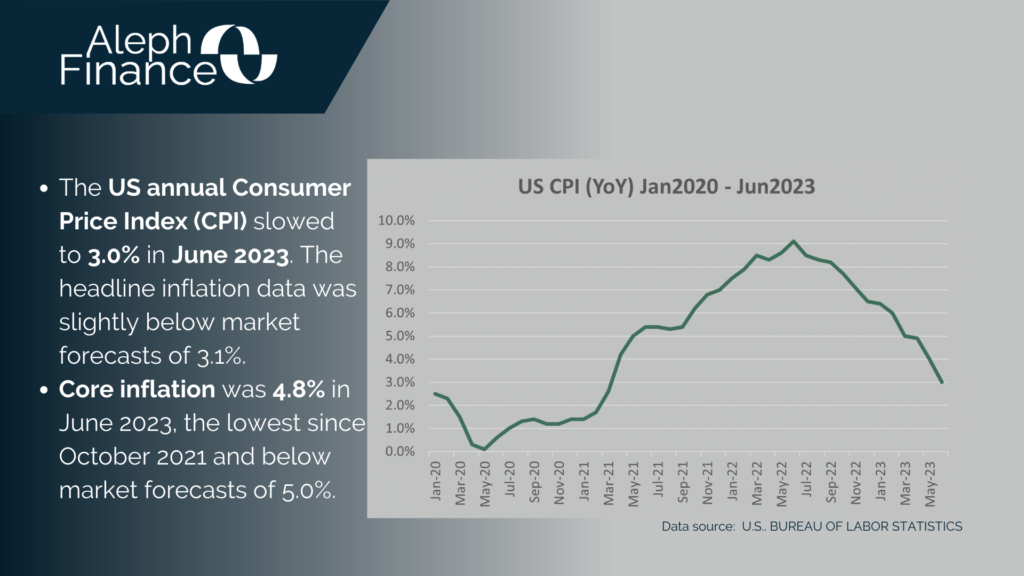

All eyes were on the US inflation published by the US Bureau of Statistics today. Both headline and core data slowed in June 2023. The CPI was 3.0% year-over-year in June, from 4.0% the prior month and slightly below the market forecast of 3.1%. Core CPI, which excludes food (5.7%) and energy (-16.7%), slowed to 4.8% in June 2023, below market forecast and down from 5.3% in May.

US consumer inflation is easing, with the June headline data being at its lowest since March 2021 and marking 12 consecutive months of slowing. However, it still remains above the Fed’s 2% target. In its effort to tame inflation, the Fed has raised its target rate to 5.00% – 5.25%. Several Fed members are in favor of continuing rate hikes. On Monday, San Francisco Fed President Mary Daly, Cleveland Fed President Loretta Mester and Fed’s Vice Chair of Supervision Michael Barr said that further rate hikes are needed.

Following the release of the data, US futures went up. Hopes that the Fed will soon end its aggressive monetary policy tightening are rising but the market is still sticking with 25 bps on July 26 because of the strong labor market data published last Friday.