This is an important week for central banks, with the Fed, the ECB and the BoJ all meeting to decide on their monetary policy.

Yesterday was the Fed’s turn. After halting in June, the Federal Open Market Committee (FOMC) announced a quarter percentage point rate hike at its July 2023 meeting. The increase was widely expected by the markets, as the Fed previously anticipated the possibility of two more rate hikes by the end of the year. The federal funds rate is now at a target range of 5.25% – 5.50%, the highest in 22 years.

The focus was on Fed Chair Powell’s press conference as markets were looking for a hint on forward guidance. Chair Powell left the door open stating that “it is certainly possible that we would raise funds again at the September meeting, if the data warranted. And I would also say it’s possible that we would choose to hold steady at that meeting.”

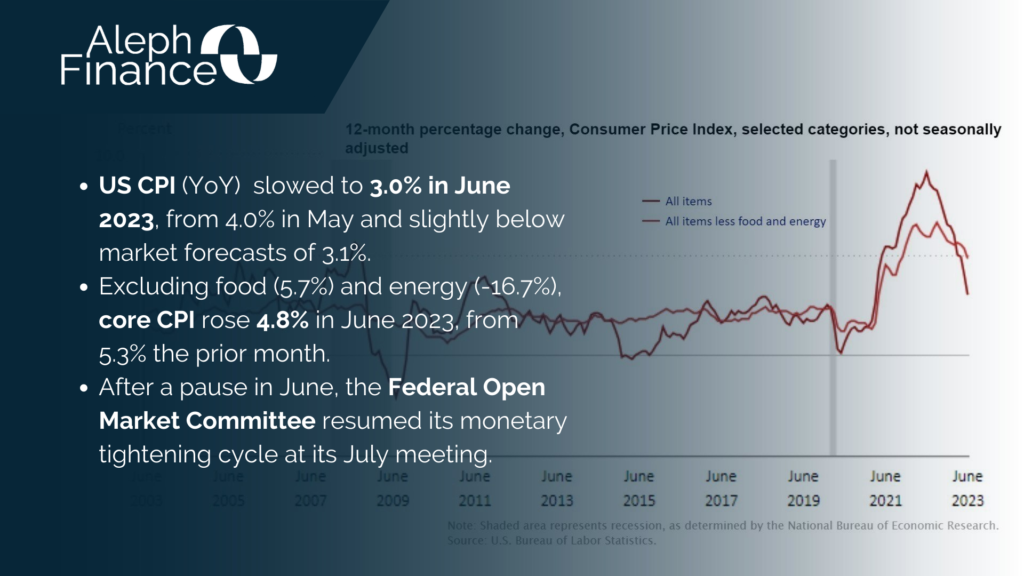

The Fed resumed its restrictive policy stance, with inflation still above its 2% target, a still tight labor market and a still resilient economy. According to the US Bureau of Labor Statistics, headline CPI was 3.0% year-over-year in June 2023, while core inflation was 4.8%. Nonfarm payrolls rose 209K in June 2023, from 306K the prior month. The unemployment rate lowered to 3.6% in June 2023, from May’s 3.7%.

Following the Fed announcement, US markets were flat, US 10yr Treasury remained in area 3.80%.