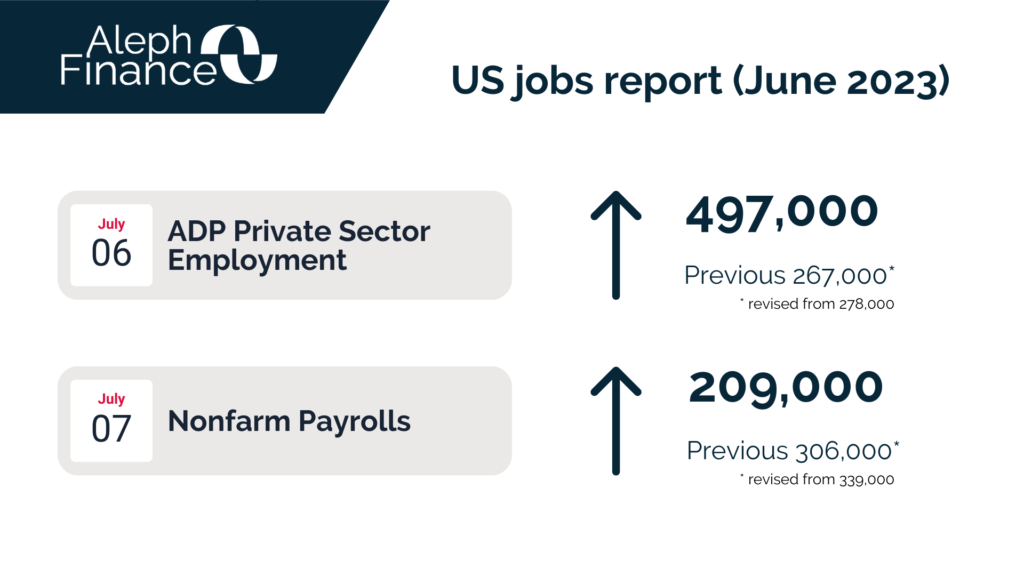

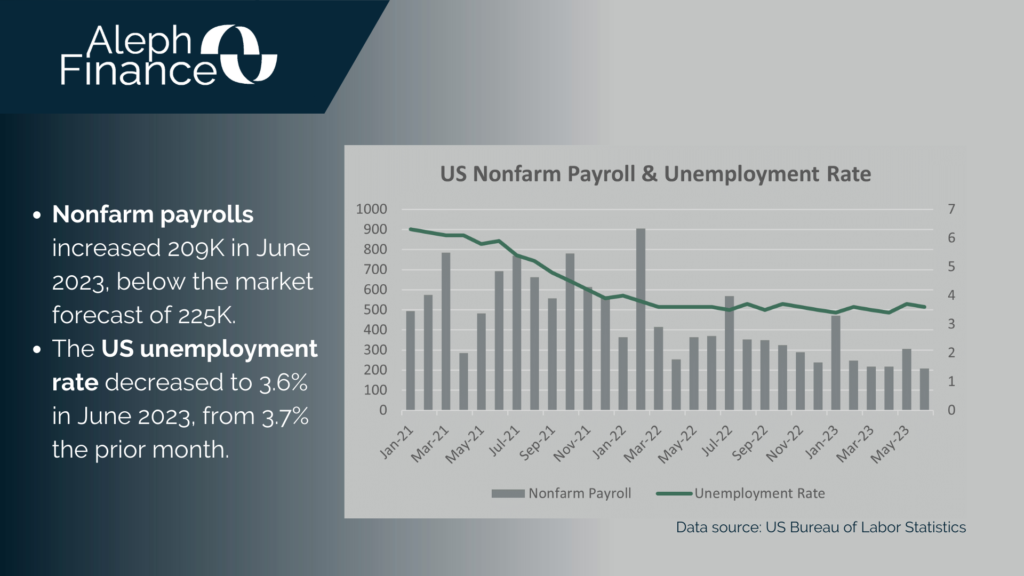

The US labor market remained resilient. Today, the US Bureau of Labor Statistics reported that nonfarm payrolls increased by 209.000 in June 2023, below the market forecast of 225.000. The US unemployment rate decreased to 3.6% in June 2023, from 3.7% the prior month. Year-over-year average hourly earnings increased by 4.4%, above market forecasts of 4.2%. These data came after yesterday’s ADP report which showed that 497.000 private employment were created in June 2023, well above the market forecast of 228.000 and from a downwardly revised 267.000 in May.

After the ADP report, the 2-year treasury yield topped 5% (since 2001 it happened on only 65 days). After the nonfarm report, US indexes futures fluctuated.

The preferred inflation gauge by the Fed, core PCE, slowed to 4.6% in May 2023, below the forecast of 4.7%. However, it is still well above the central bank’s 2% target. Markets are pricing in 25 bps rate hike in July. The CME FedWatch Tool is also showing a higher chance of a quarter point rate hike, which will bring the target rate to 5.25% – 5.50%.

The Fed left the interest rate unchanged at its June meeting but signaled more hikes ahead. “We believe there’s more restriction coming and what’s really driving it … is a very strong labor market,” said Fed Chair Powell last week during a Q&A session at the ECB Forum on Central Banking.

All eyes will be on the next release of CPI data on July 12, ahead of the FOMC meeting.