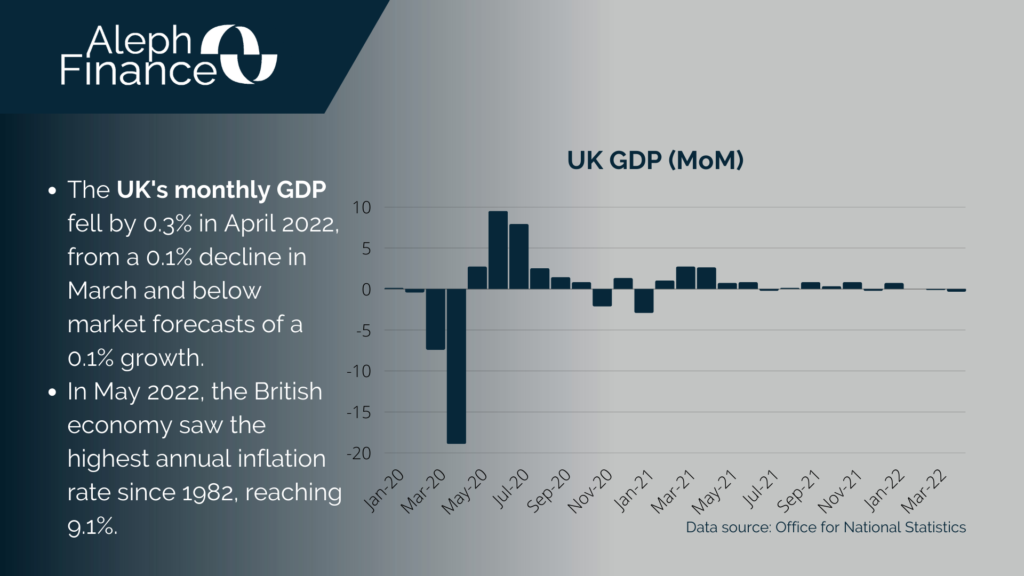

The UK is heading into a recession, as the cost of living keeps rising and growth is slowing. According to the Office for National Statistics, the British economy fell 0.3% (MoM) in April 2022. This reading came after a contraction of 0.1% the prior month and was lower than the expected growth of 0.1%. Services (-0.3%), production (-0.6%) and construction (-0.4%) contributed negatively to the monthly GDP.

The fight against inflation led the Bank of England to raise its bank rate five times in a row by 25 basis points. This brings the bank rate to 1.25% at the June 2022 meeting.

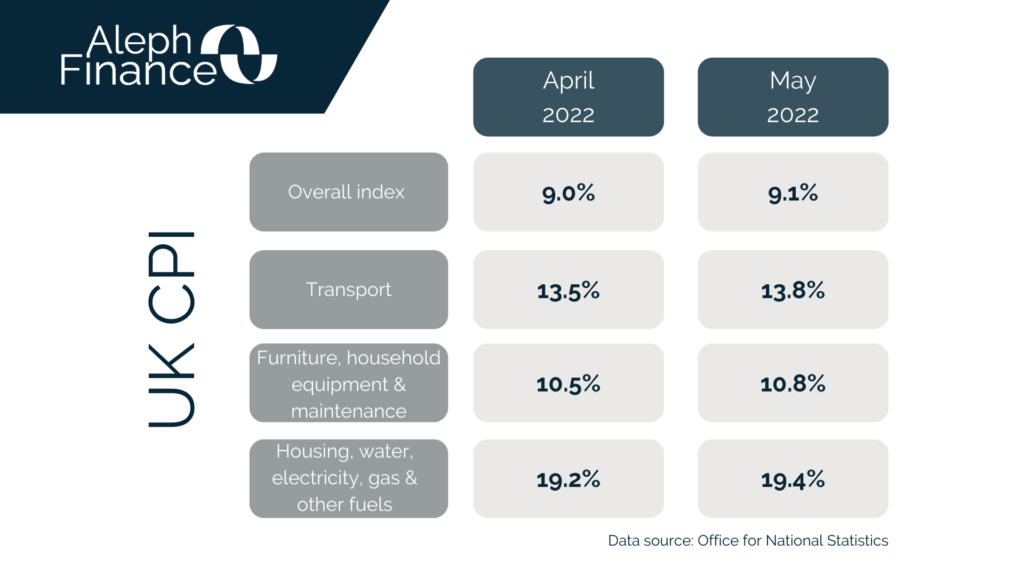

Cost pressures do not appear to be slowing down as the UK’s latest annual CPI released today by the Office for National Statistics reached 9.1% in May 2022. This figure, the highest since 1982, followed an increase of 9% in April and is line with expectations. The main drivers of inflation are housing, water, electricity, gas & other fuels (19.4%), transport (13.8%) and food & non-alcoholic beverages (8.6%). Soaring prices continue to put a strain on consumers’ living standards. A further sign of the cost of living crisis is the increasing pessimistic view of consumers. The UK Consumer Confidence survey conducted by GfK showed a record low of -40 in May 2022. “This means consumer confidence is now weaker than in the darkest days of the global banking crisis, the impact of Brexit on the economy, or the Covid shutdown,” said Joe Staton, GfK’s client strategy director.