The wait is over. Yesterday the Federal Reserve announced its latest monetary policy.

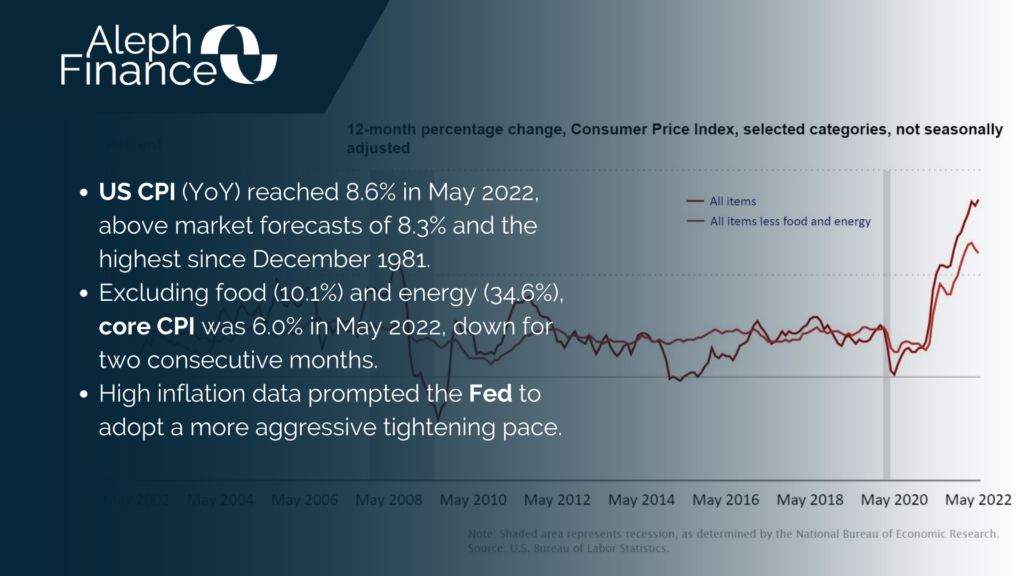

In the days leading up to the Fed’s press conference, markets were pricing a three-quarter percentage point interest rate hike, the largest since 1994. The change in expectations from a rise of 50 basis points to a rise of 75 basis points was supported by latest macroeconomic figures. Last Friday, the annual CPI unexpectedly increased to 8.6% in May 2022. The Michigan inflation expectations also rose, forecasting an increase of 5.4% for next year.

Just hours away from the Fed’s announcement, the Census Bureau reported a decline of 0.3% month-over-month of retail sales in May 2022, as consumers starts to spend less due to soaring prices.

Market expectations were confirmed as the FOMC raised the funds rate by 75 basis points to tame inflation. The benchmark funds rate now has a target range of 1.50% to 1.75%. The Fed’s decision was well welcomed by investors, as US stocks rallied soon after the press conference. Fed Chair Powell also stated that a 50 basis point or a 75 basis point is mostly likely for the next meeting in July.

The FOMC also released its economic projections. Members expect the fund rate to rise to a midpoint rate of 3.4% by the end of the year, higher than the 1.9% March projection. PCE inflation is also revised upwards to 5.2% in 2022, from the March projection of 4.3%. The economy is expected to grow by 1.7% this year, below 2.8% anticipated in March.