The cost of living crisis continues to weigh on consumers. Flash consumer confidence in the Euro area fell to -23.6 in June 2022, a further decline from -21.2 in May and closer to the all-time low reached in April 2020 when the pandemic first hit. The consumer sentiment indicator released on Wednesday by the European Commission was also lower than market expectations of -20.5.

Recession fears persist as inflation rises and economic growth slows. Euro area inflation hit a record-high of 8.1% in May 2022, with the prices of the main components rising sharply. The inflation rate is now four times the ECB’s 2% target. At its June meeting, the central bank anticipated its intention to raise interest rates by 25 basis points in July.

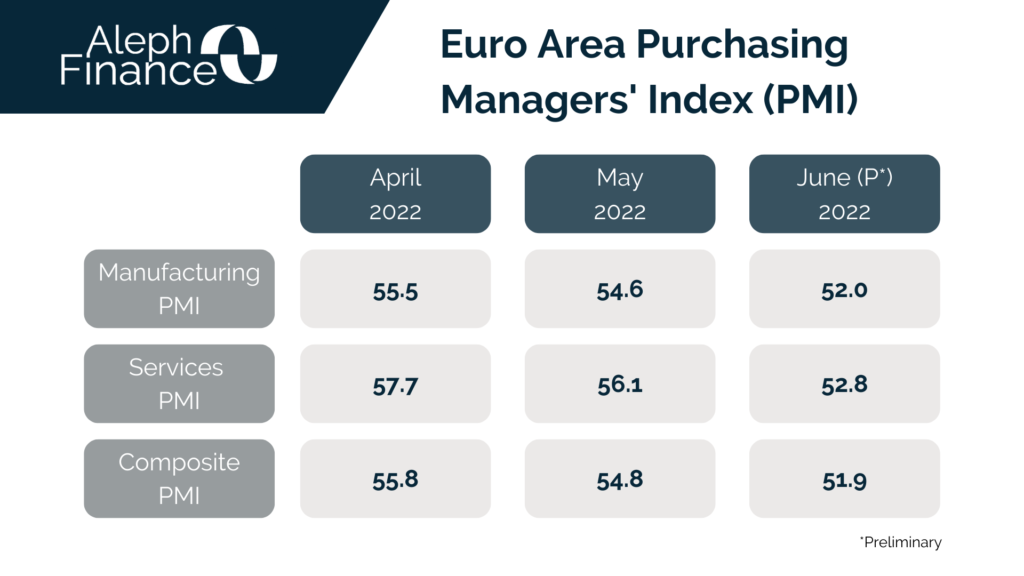

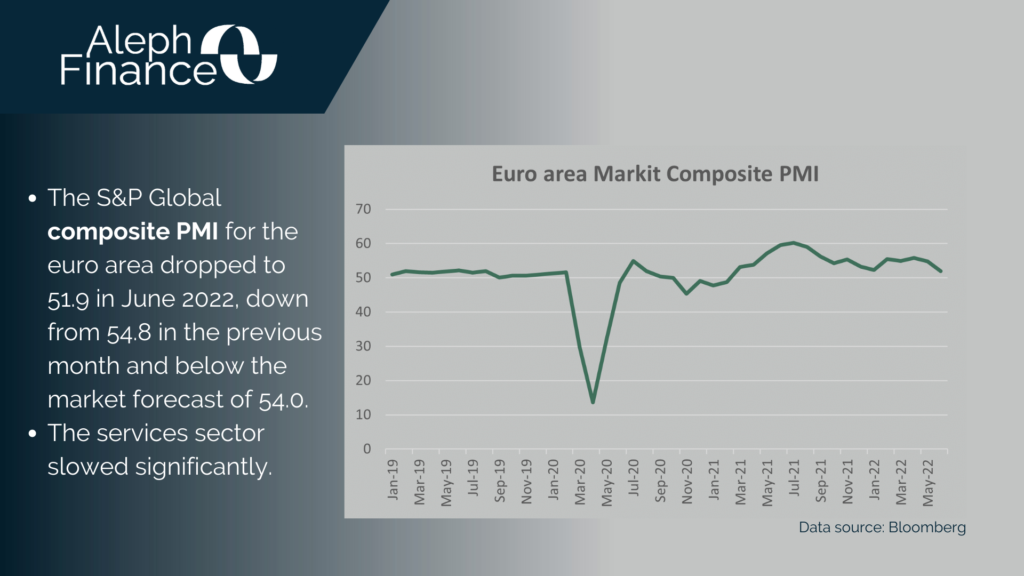

Today the focus is on the Purchasing Managers’ Index (PMI), a good indicator of the health of the economy. The figures published by S&P Global did not alleviate the fear of recession. The preliminary Euro area composite PMI dropped to 51.9 in June, from 54.8 in May and below the market forecast of 54.0. The manufacturing PMI decreased to 52.0, while the services PMI fell to 52.8.

European stocks fell due to disappointing Euro area PMI data, with all major European indices in the red.