The challenge caused by rising living expenses shows no signs of abating. After unexpectedly moving down in August, inflation in the UK rose again to the 40-year high reached in July, amid political turmoil and cost-of-living crisis. The tax cuts introduced by the former Chancellor of the Exchequer, Kwasi Kwarteng, were largely reversed in an emergency statement on Monday by his successor, Jeremy Hunt. Amid this situation, how long Truss will hold the position in office is now in question.

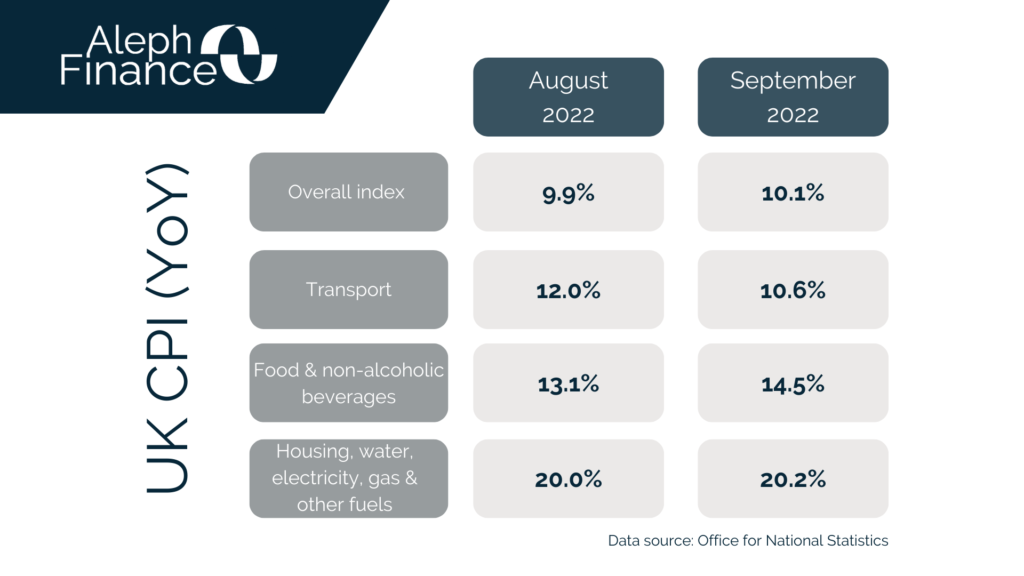

The latest annual CPI released today by the Office for National Statistics (ONS) hit 10.1% in August 2022, up from 9.9% in August and slightly above the market forecast of 10.0%. Core CPI rose to 6.5%, a new record-high and up from 6.3% in August. The main drivers of inflation were housing and household services (20.2%), transport (10.6%) and food & non-alcoholic beverages (14.5%).

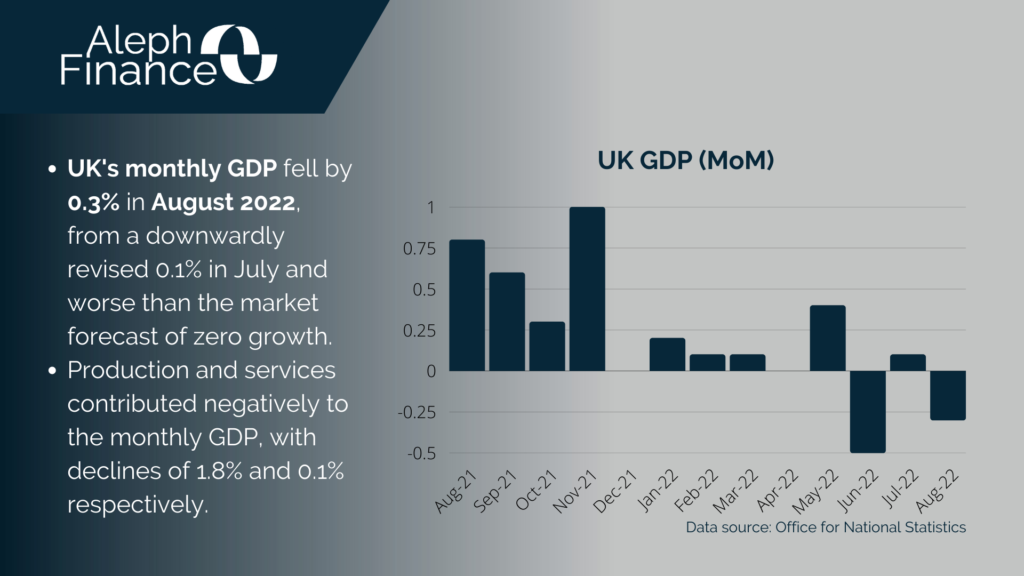

Last Wednesday, the ONS reported that the UK’s monthly GDP is estimated to have shrunk by 0.3% in August 2022, from a downwardly revised 0.1% in July and worse than the market forecast of zero growth. Production and services contributed negatively to the monthly GDP, with declines of 1.8% and 0.1% respectively.

The Bank of England (BoE) announced its seventh consecutive rate hike at its September meeting, as the fight against inflation continues. This brings the current bank rate to 2.25%. The next BoE monetary policy announcement is due on 3 November and the rate increase is expected to be bigger than usual.