Today, market watchers are focused on the European Central Bank (ECB) and its latest monetary policy announcement.

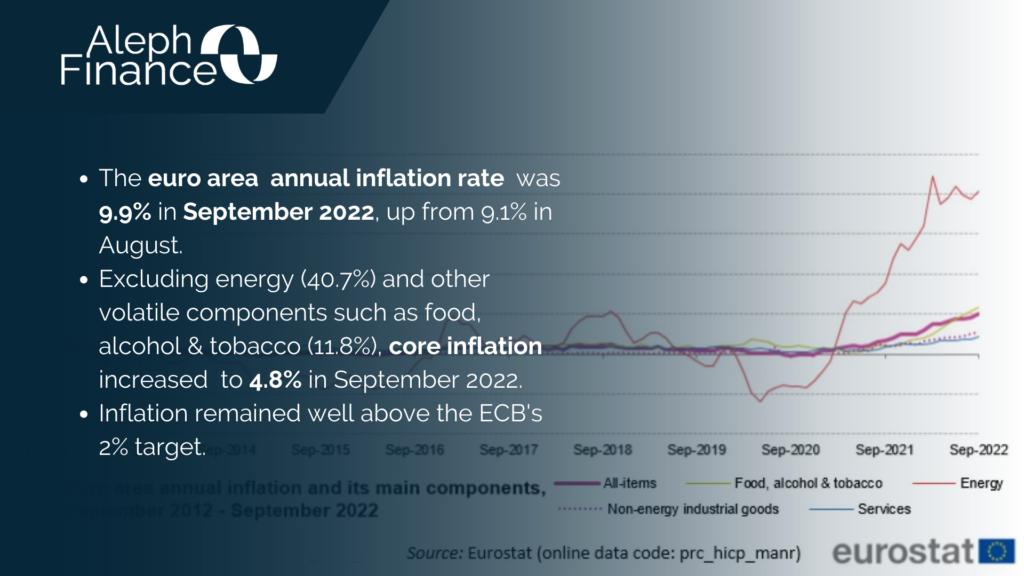

Worries about a severe recession grow, as European firms face surging inflation, in particular higher energy costs. Inflation was 9.9% in September 2022, almost five times the ECB’s 2% medium-term target and the highest rate ever recorded. The S&P Global flash composite PMI for the Euro area fell to 47.1 in October 2022, down from 48.1 in September and below the forecast of 47.5. The reading, published on Monday, showed an intensified contraction in the euro area economy.

As widely expected, the Governing Council raised the three key ECB interest rates by 75 basis points at its October 2022 meeting. This brings the deposit facility rate at 1.5%, the main refinancing operations rate at 2.0% and the marginal lending facility rate at 2.25%.

The “jumbo” rate hike is the third consecutive increase this year (50 bps in July, 75 bps in September, 75 bps in October), as the ECB tightens its monetary policy to fight soaring inflation. The Governing Council expects further raises to bring inflation down to its 2% target. Moreover, the ECB changed the terms and conditions of its targeted longer-term refinancing operations (TLTRO III), by adjusting the interest rates applicable from November 23 and offering banks voluntary early repayment dates.

There is no big market movement as the 75 bp rate hike was highly expected.