Inflation persists amid a highly uncertain environment and a volatile market. On Tuesday, the IMF published its latest World Economic Outlook Report and highlighted that the cost-of-living crisis, Russia’s invasion of Ukraine and China’s slowdown are adversely impacting the forecast. The IMF’s global growth estimate for 2022 remains unchanged at 3.2% in 2022, but it has been revised down to 2.7% in 2023 (from 2.9% seen in the July projections). The IMF also estimates that the rate of global inflation would increase to 8.8% in 2022 before falling to 6.5% in 2023 and 4.1% by 2024.

Yesterday, the US Bureau of Labor Statistics released the Producer Price Index (PPI), a gauge of wholesale inflation. The PPI increased 0.4% month-over-month in September 2022, twice the market forecast (year-over-year PPI rose 8.5%).

Today’s inflation data was closely followed to assess the Federal Reserve’s next rate hike at the November meeting, where a fourth consecutive rate hike of 75 basis points is highly expected. Right after the data was released, the CME FedWatch Tool was showing 88.4% probability of a 75 basis point increase.

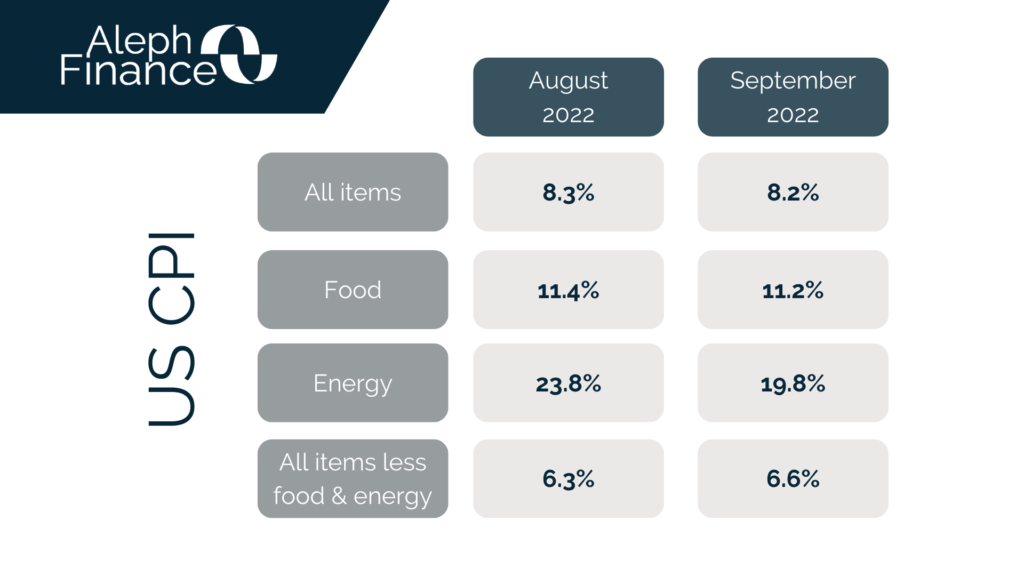

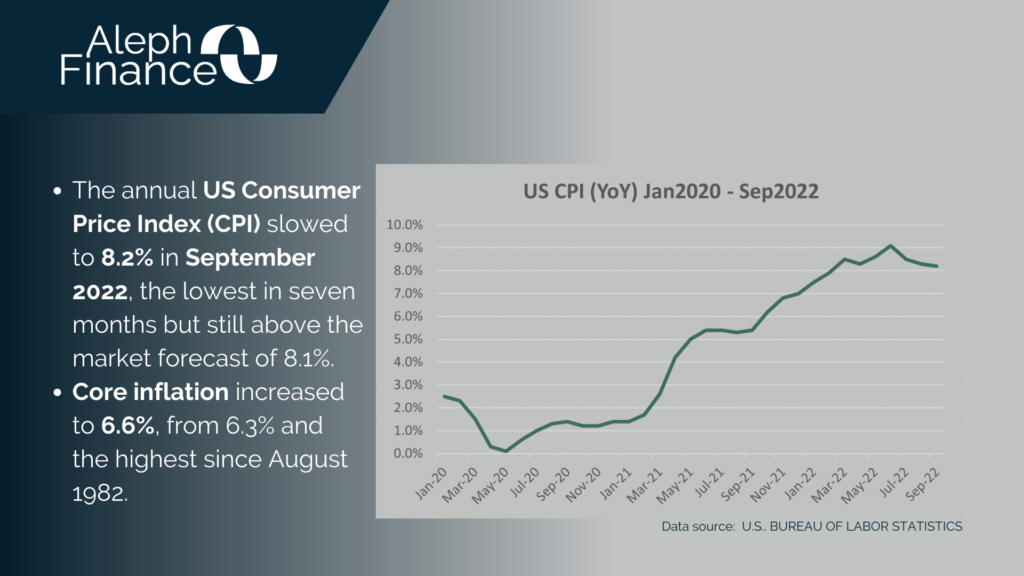

According to the US Bureau of Labor Statistics, the CPI slowed to 8.2% year-over-year in September 2022, down from 8.3% in August, but slightly above the market forecast of 8.1%. Core CPI increased to 6.6% in September 2022, from 6.3% of the prior month and higher than the market forecast of 6.5%.