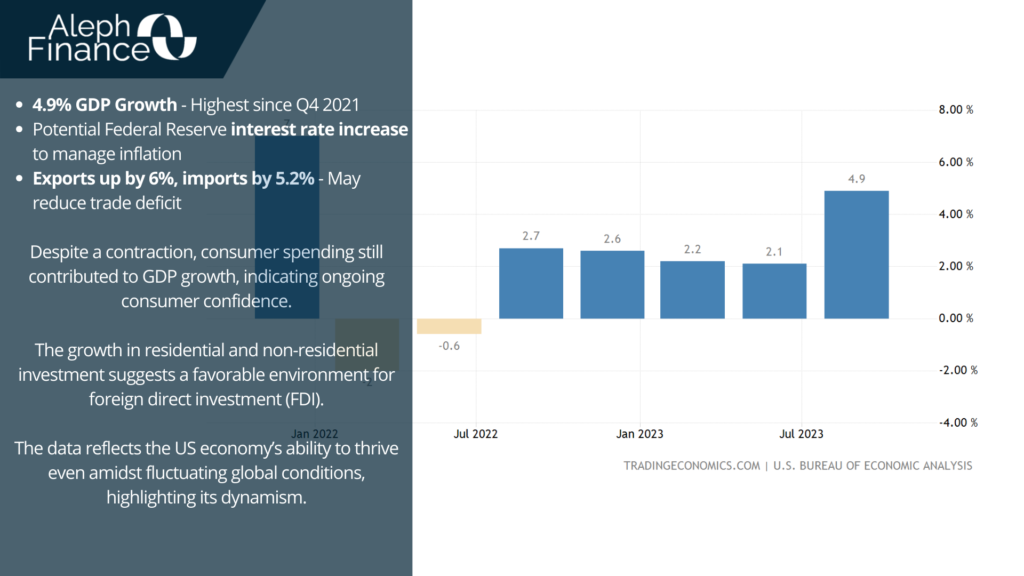

In Q3 2023, the US economy demonstrated considerable resilience, registering an annualized growth rate of 4.9%. Although marginally lower than the previously reported 5.2%, this figure is in line with the initial advance estimate and marks the most substantial growth since Q4 2021 (previous growth rate: 2.1%).

This robust economic expansion could potentially influence the Federal Reserve’s monetary policy. Should the economy maintain this growth trajectory, the Federal Reserve may contemplate an increase in interest rates to prevent economic overheating and manage inflation effectively.

The impressive GDP growth could have significant implications for international trade. With exports surging by 6% and imports rising by a slightly lesser 5.2%, the US is enhancing its competitiveness on the global stage. This could potentially lead to a reduction in the trade deficit, thereby fortifying the US economy further. However, it is crucial to examine the distribution of this growth. If the benefits of growth are not equitably dispersed, it could exacerbate income inequality.

The primary driver behind this revision was a contraction in consumer spending. Nevertheless, the overall increase in real GDP was propelled by several factors, including growth in consumer spending, private inventory investment, exports, imports, state and local government spending, federal government spending, residential fixed investment, and non-residential fixed investment. It is noteworthy that imports were revised downwards.

The vigorous growth in both residential and non-residential investment signals a conducive investment environment. This could potentially draw more foreign direct investment (FDI) into the US, providing an additional boost to the economy.

This period of economic expansion underscores the resilience and dynamism of the US economy, even amidst fluctuating global economic conditions. The data highlights the critical role of various sectors in driving growth, underscoring the multifaceted nature of the US economy. As we progress, these trends will be instrumental in shaping the economic landscape.