In December 2023, the United States witnessed notable movements in core consumer prices and inflation rates, providing insights into the economic landscape. Let’s delve into the data to better understand these trends and their potential implications.

The US core consumer prices, excluding volatile elements like food and energy, exhibited a 0.3% month-on-month increase in December 2023, aligning with both the November figures and market expectations. This stable trajectory reflects the resilience of the economy. Over the years, the Core Inflation Rate MoM in the United States has averaged 0.30 percent, with the highest recorded at 1.42 percent in March 1980 and the lowest at -0.49 percent in April 2020.

Examining the annual perspective, core consumer prices in the United States showed a 3.90 percent increase in December 2023 compared to the same month in the previous year. The historical average of the Core Inflation Rate in the United States stands at 3.63 percent, with peaks at 13.60 percent in June 1980 and a record low of 0 percent in May 1957.

Considering the broader Consumer Price Index (CPI), there was a 0.30 percent month-on-month rise in December 2023. The Inflation Rate MoM in the United States has averaged 0.29 percent over the years, with the highest observed at 2 percent in September 1947 and the lowest at -1.80 percent in November 2008.

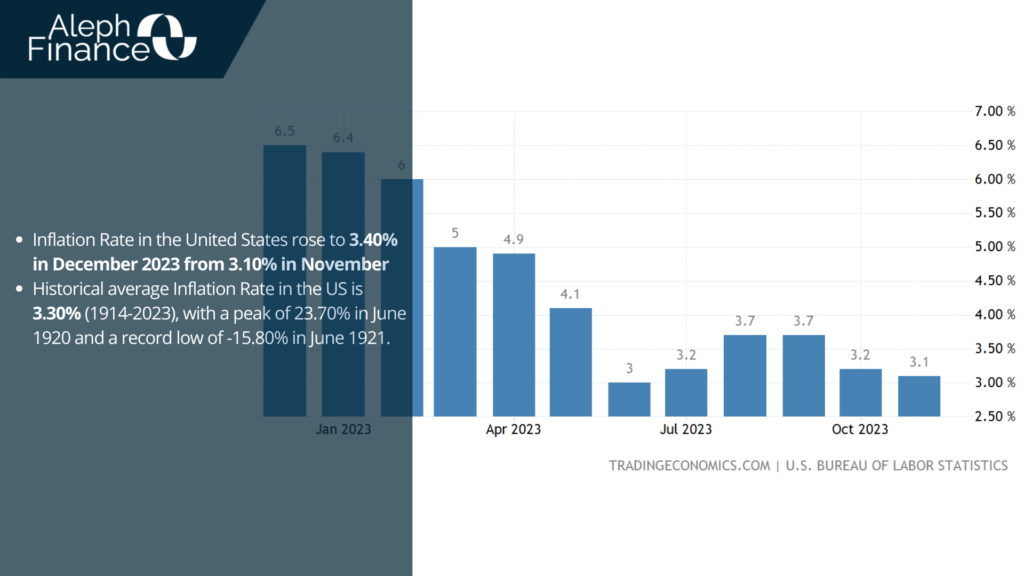

In terms of overall inflation, the Inflation Rate in the United States increased from 3.10 percent in November 2023 to 3.40 percent in December 2023. The historical average Inflation Rate in the United States is 3.30 percent, reaching its peak at 23.70 percent in June 1920 and hitting a record low of -15.80 percent in June 1921.

These recent developments in core consumer prices and inflation rates provide a nuanced view of the economic dynamics in the United States. Investors and policymakers will closely monitor these trends for potential impacts on monetary policy and investment decisions in the coming months.