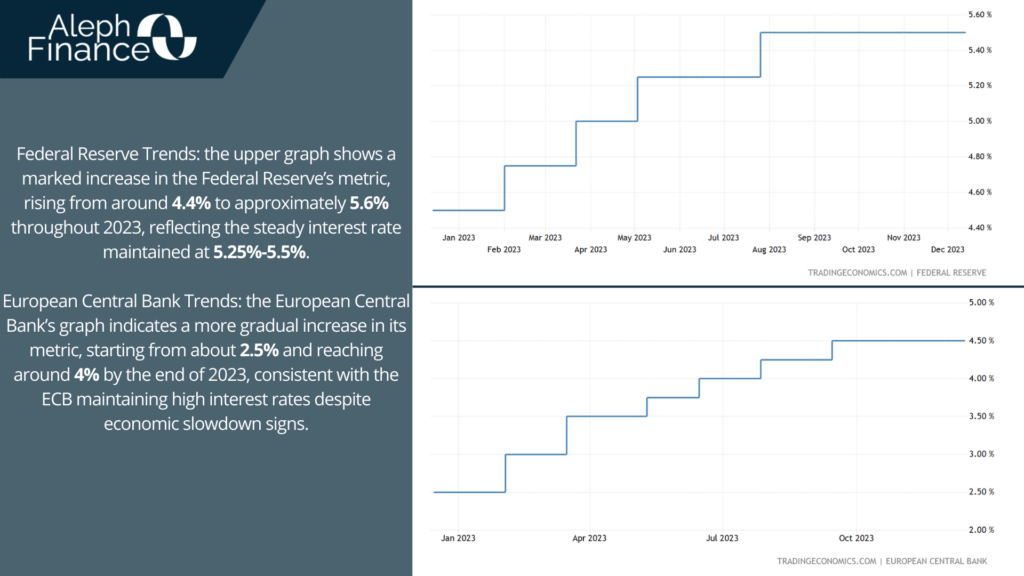

In December 2023, the Federal Reserve held the fed funds rate at 5.25%-5.5% for the third time in a row, hinting at a 75-basis points reduction in 2024. Despite a slowdown in economic growth and a moderation in job gains, the unemployment rate has remained very contained.

Inflation has softened over the past year, but it is still high. The Fed’s new projections show an increase in GDP growth for this year (2.6% compared to 2.1% in the September projection), but a slight decrease in 2024 (1.4% compared to 1.5%). PCE inflation forecasts for both 2023 (2.8% vs 3.3%) and 2024 (2.4% vs 2.5%) were revised downwards, as were the core PCE inflation projections for 2023 (3.2% vs 3.7%) and 2024 (2.4% vs 2.6%).

Unemployment projections remained unchanged at 3.8% for 2023 and 4.1% for 2024. The median year-end 2024 projection for the federal funds rate, as shown in the so-called dot plot, dropped to 4.6% from 5.1% in September.

On the other hand, the European Central Bank kept interest rates at multi-year highs for the second meeting in a row on Thursday, despite signs of slowing economic growth. The main refinancing operations rate stayed at a 22-year high of 4.5%, and the deposit facility rate remained at a record 4%. The market is now looking forward to President Lagarde’s remarks, especially her recognition of the unexpectedly fast drop in inflation and the ECB’s position on potential interest rate cuts.

Both the Federal Reserve and the European Central Bank have kept their interest rates steady despite indications of slowing economic growth. However, the Federal Reserve has indicated potential rate cuts in 2024, while the European Central Bank has maintained rates at multi-year highs. This suggests a divergence in monetary policy between the two regions, with the US potentially easing its policy stance while Europe remains more hawkish.

About inflation, in November 2023, US consumer prices saw a slight increase of 0.1% from the previous month, contrary to the anticipated flat reading. This was primarily due to a rise in shelter costs, which offset a decrease in the gasoline index. Shelter prices increased by 0.4%, marking the largest factor in the monthly increase. Meanwhile, the used cars and trucks index rose by 1.6%, breaking a five-month streak of decreases. The food index saw a smaller rise of 0.2%.

Energy price index fell by 2.3% due to a 6% drop in the gasoline index, which outweighed increases in other energy components such as electricity (1.4%) and natural gas (2.8%). The annual inflation rate in the US decelerated to 3.1% in November 2023, marking a five-month low and aligning with market predictions. Energy costs fell by 5.4%, with significant declines in gasoline (8.9%), utility gas service (10.4%), and fuel oil (24.8%).

Price increases slowed for food (2.9% vs. 3.3%), shelter (6.5% vs. 6.7%), new vehicles (1.3% vs. 1.9%), and apparel (1.1% vs. 2.6%), while prices continued to fall for used cars and trucks (-3.8% vs -7.1%). Conversely, prices accelerated for medical care commodities (5% vs 4.7%) and transportation services (10.1% vs. 9.2%). Core inflation remained steady at 4%, and the monthly rate increased to 0.3% from 0.2%, matching forecasts.

When comparing the inflation rates between the US and Europe, it’s evident that both regions are grappling with high inflation rates. However, the US Federal Reserve has indicated potential rate cuts in 2024, which could help to ease inflation. In contrast, the European Central Bank has maintained rates at multi-year highs, suggesting a more hawkish stance on inflation.