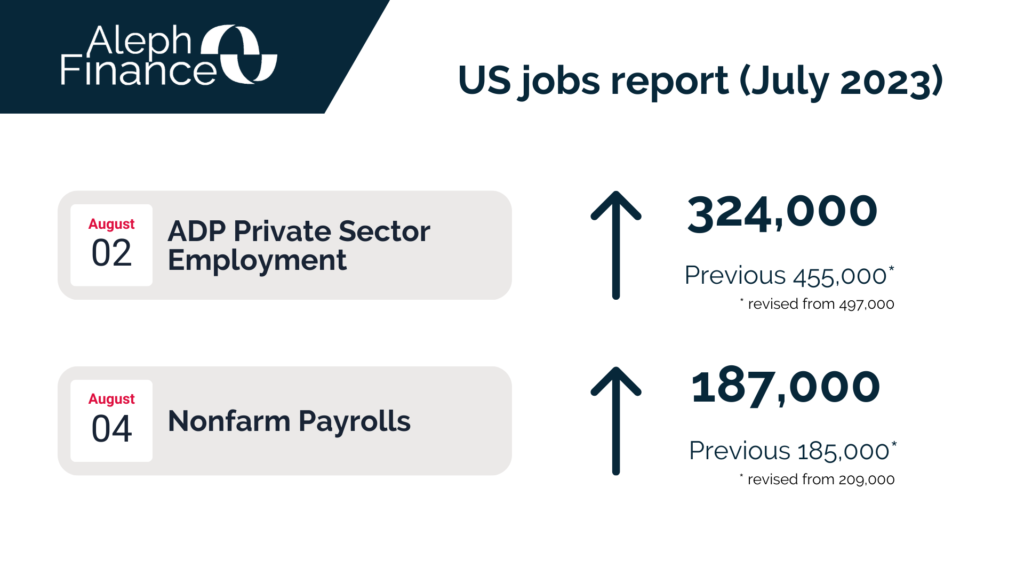

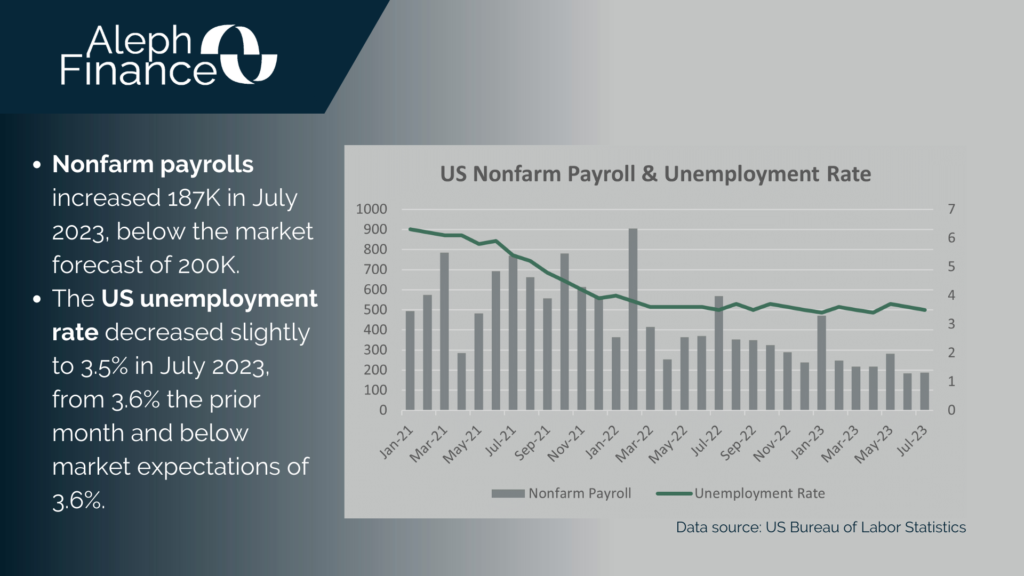

The US labor market remains strong, but it is starting to show signs of cooling. On Wednesday, the ADP report showed that 324.000 jobs were created in the private sector in July 2023, well above the market forecast of 189.000 and from a downwardly revised 455.000 the prior month. Today, the US Bureau of Labor Statistics reported that nonfarm payrolls increased by 187.000 in July 2023, below the market forecast of 200.000. The best sectors were health care, financial activities and construction. The US unemployment rate decreased to 3.5%, from 3.6%. Annual average hourly earnings increased by 4.4%, above market forecasts of 4.2%.

US economy continues to show resilience despite the Fed’s efforts to slow it down. According to the US Bureau of Economic Analysis, US GDP advance estimate for the second quarter of 2023 grew by 2.4%. The data published was higher than 2% in Q1 and the market forecast of 1.8%. Core PCE, a key inflation indicator, slowed to 4.1% in June 2023, from 4.6% the prior month.

Bringing inflation down to 2% remains the Fed’s main goal. After a pause in June, the Fed resumed raising rates at its July 2023 meeting, bringing the current target rate at 5.25% – 5.50%. The CME FedWatch Tool is currently pricing a higher chance of another pause, which will leave the rate unchanged.