The PCE price index, a key indicator of inflation in the US, was released today and core data showed that inflation slowed in May. The stock market remains volatile as the Fed struggles to keep inflation under control. In May 2022, US annual CPI reached 8.6%, the highest in 40 years, while core inflation slowed to 6%.

Last week, Chair Powell testified to the Congress and said that the Fed is “strongly committed” to bringing inflation down. In response to senators’ question, Powell also stated that the risk of a recession cannot be ruled out. The Fed raised the funds rate at its last three meetings (by 25 bp in March, by 50 bp in May and by 75 bp in June). This brings the Fed’s benchmark interest rate to a current target range of 1.50% to 1.75%. Further rate increases are expected as the Committee deems it “appropriate”.

The fear of recession continues to intensify after other disappointing macroeconomic data in the US. Consumer Confidence declined in June 2022 and was weaker than expected. The final GDP reading for the first quarter of 2022 published yesterday by the US Bureau of Economic Analysis was slightly worse than the second reading. The US economy shrank by 1.6%, revised down by 0,1% from the second estimate.

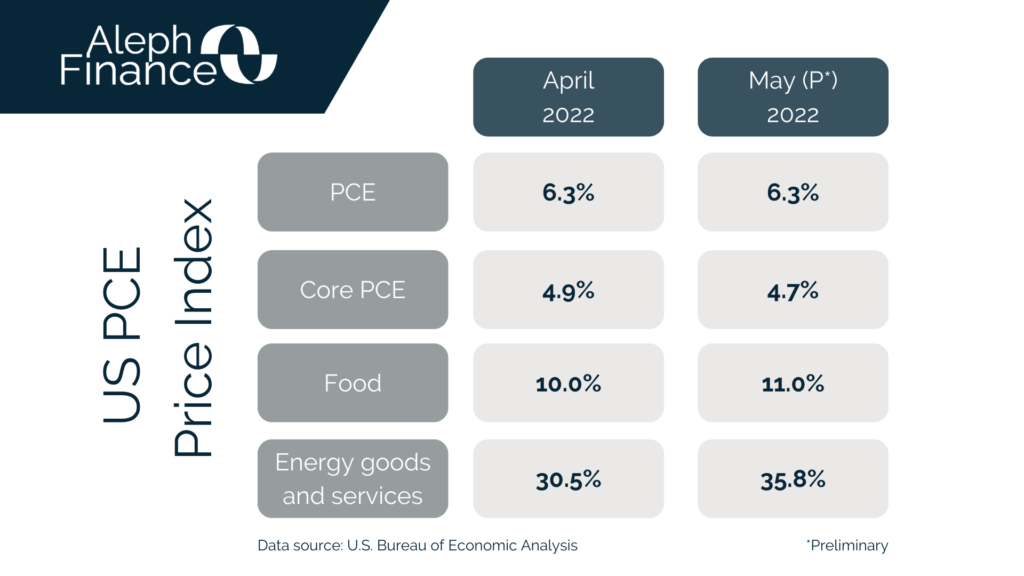

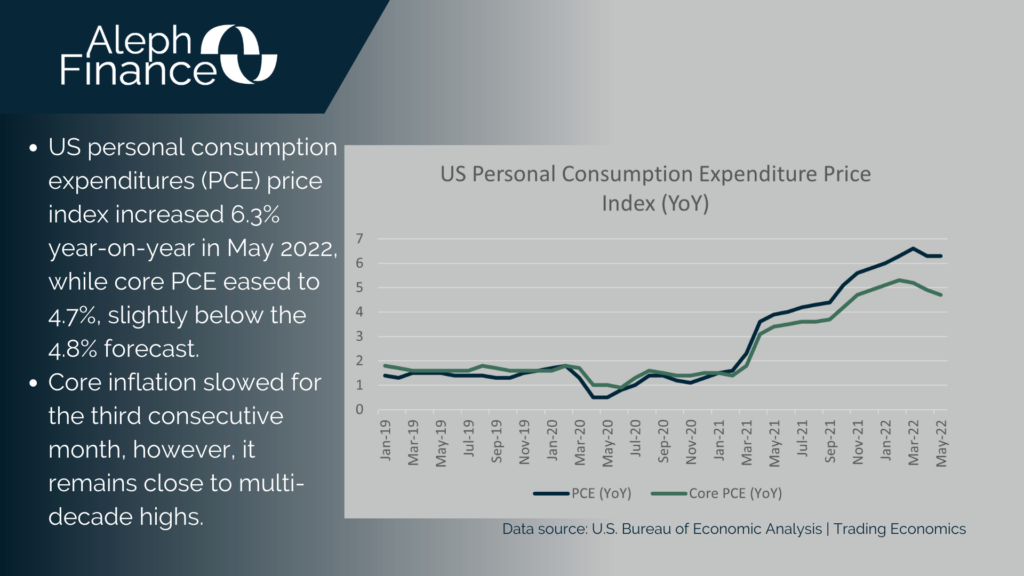

According to the US Bureau of Economic Analysis, the headline PCE price index rose 6.3% year-on-year in May 2022, the same as the prior month. Core PCE price index slowed to 4.7% in May, from 4.9% in April. Food was 11,0%% in May, while energy goods and services were 35.8%.

As the second quarter of 2022 comes to a close, market sentiment continues to be dominated by uncertainty and concerns about the economy heading into recession.