Inflation seems to be slowly easing however its shocks continue to be felt by the economy. Despite concerns brought by the crisis in the banking sector, central banks decided to continue raising rates to fight soaring prices. In fact, the ECB hiked its interest rates by 50 bps at its meeting in March. “There is no trade-off between price stability and financial stability” President Lagarde said during her speech at “The ECB and Its Watchers XXIII” conference.

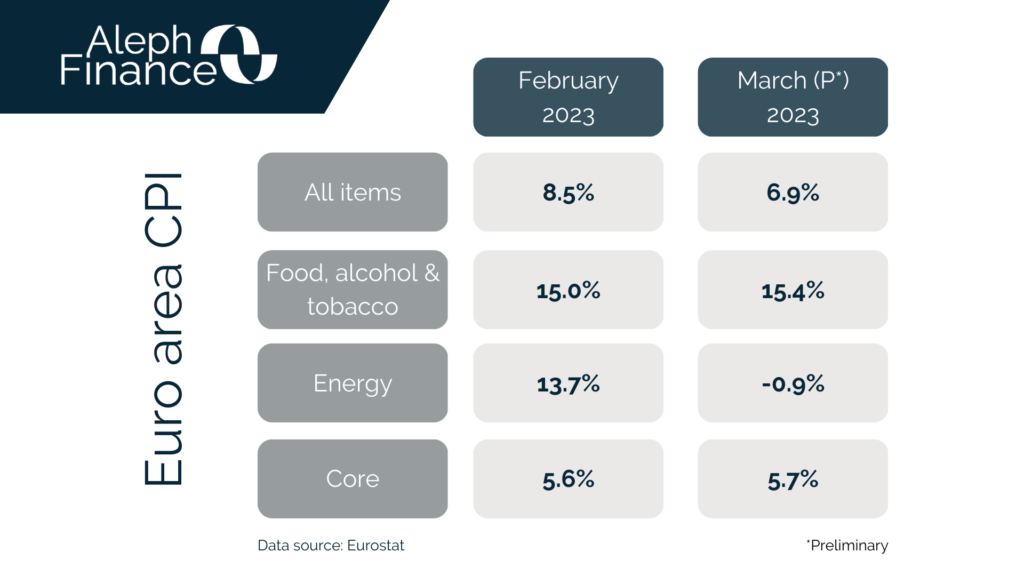

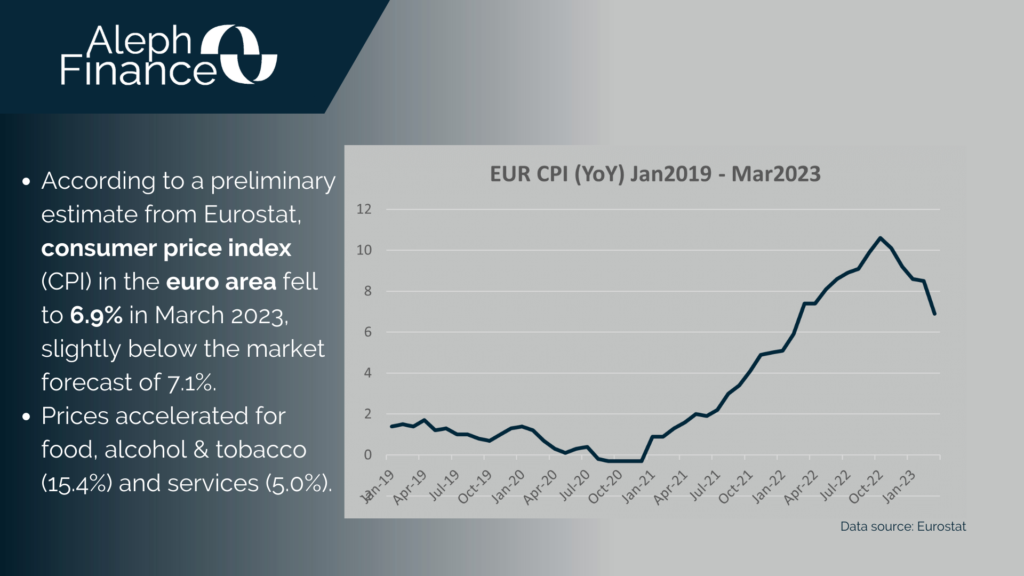

On the macroeconomic front, the focus today was on the preliminary inflation data in the euro area. According to Eurostat, the annual consumer price index (CPI) slowed to 6.9% in March 2023, from 8.5% in February. The headline inflation was slightly below the market forecasts of 7.1% and the lowest since February 2022. However, core CPI increased to 5.7% in March 2023, a new record high. Latvia (17.3%), Estonia (15.6%) and Lithuania (15.2%) were among the EU countries with the highest annual inflation rates. Luxembourg (3.0%) and Spain (3.1%) registered the lowest rates. Prices accelerated for food, alcohol & tobacco (15.4%) and services (5.0%).

In any case, the market appreciated that the real data was below forecast so we are having a bit of improvement in European govi’s prices. Equities remain steady.