US macroeconomic data released this week showed signs of a slowdown in the economy. The ISM manufacturing and services PMIs were both weaker than forecasts. On Wednesday, the ADP report showed that just 145.000 private payrolls were added in March 2023, below the market forecast of 200.000 and an upwardly revised 261.000 in February.

On Thursday, Fed member James Bullard said that inflation will likely remain persistent. US headline inflation was 6% in February 2023, three times higher than the Fed’s 2% target. Before the release of nonfarm payrolls, the CME FedWatch Tool was showing 56.4% chance of a 25 basis point rate hike at the next meeting in May, which will bring the target rate to 5.00% – 5.25%.

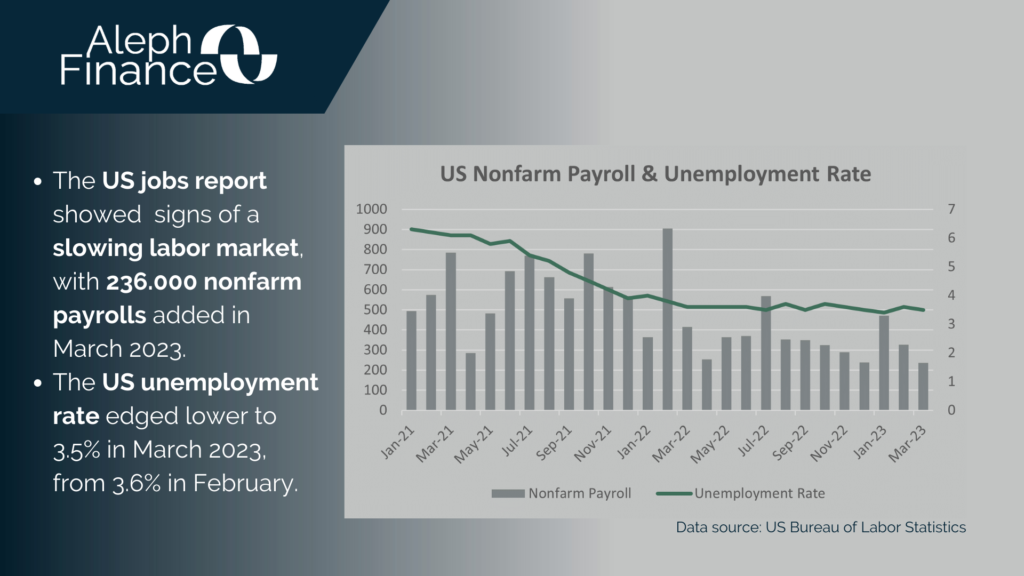

Today, the US Bureau of Labor Statistics reported that nonfarm payrolls increased by 236.000 in March 2023, close to market forecasts of 239.000. The US unemployment rate was 3.5% in March 2023. Year-over-year average hourly earnings increased by 4.2%, slightly below market forecasts of 4.3%.

Nonfarm payroll data confirmed a slight weakening in the US labor market. All eyes will be on the next release of CPI data on April 12, ahead of the FOMC meeting.