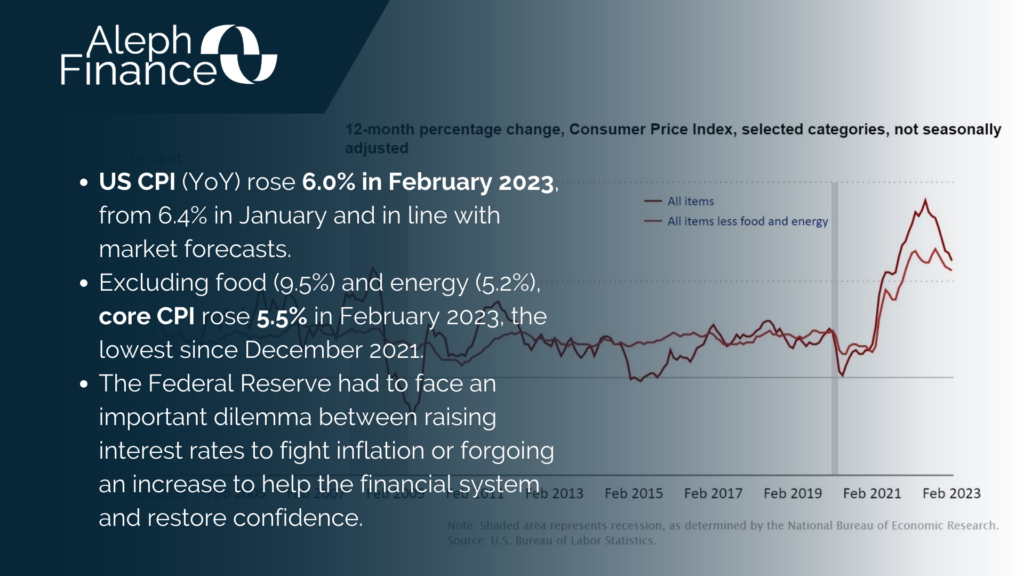

The market has been shaken by recent events in the banking sector, with the solvency problems of some US regional banks and the UBS takeover of Credit Suisse. Amid banking turmoil, concerns have been raised about systemic risks to the global financial system. The Federal Reserve had to face an important dilemma between raising interest rates to fight inflation or forgoing an increase to help the financial system and restore confidence.

On Wednesday, the Federal Open Market Committee (FOMC) announced a 25-basis-point increase in the funds rate, marking the ninth consecutive hike since it started raising rates a year ago in March 2022. This brings the Fed funds rate range at 4.75% – 5.00%. “The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time,” said the FOMC statement. US inflation currently runs three times the Fed’s 2% target, with US CPI at 6% in February 2023, while core CPI was 5.5%.

The FOMC also released its economic projections. The “dot plot” indicated that the members expect to reach rate hikes at 5.1% in 2023, which is the same as the previous estimate from December. This suggests that the majority of officials anticipate just one more rate increase. PCE inflation was slightly revised upwards, expected to reach 3.3% in 2023 (from 3.1% December projection). Following the Federal Reserve’s announcement, US stocks fell around 1.5% in Wednesday’s session.