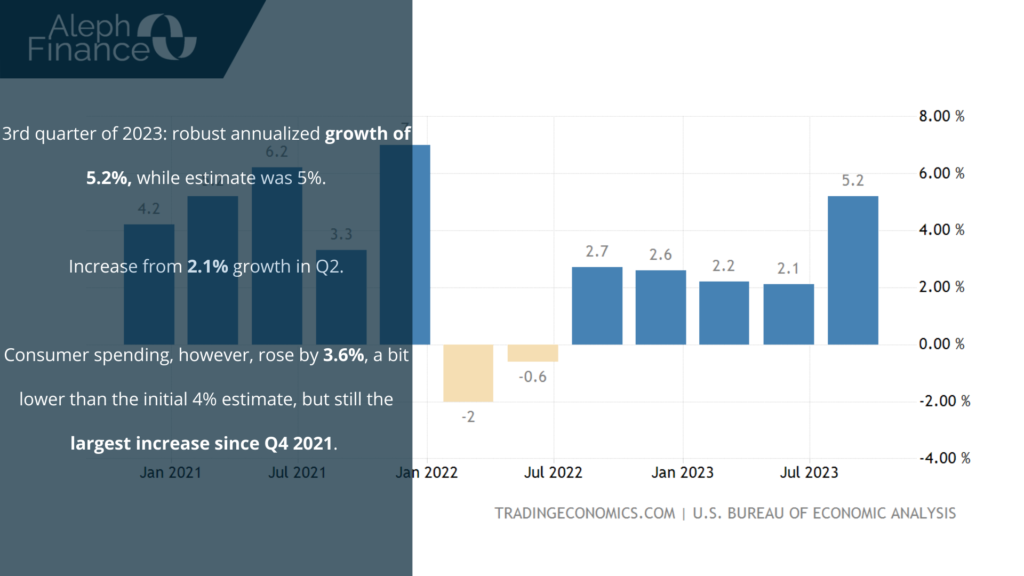

In the third quarter of 2023, the US economy saw a robust annualized growth of 5.2%. This surpassed market predictions of 5% and showed a considerable increase from the 2.1% growth in Q2. This is the most vigorous expansion since the last quarter of 2021. The nonresidential investment was adjusted upwards to a 1.3% increase, contrary to the initial 0.1% decrease. This was due to a less severe decline in equipment (-3.5% vs the initial -3.8%) and a significant 6.9% surge in structures, compared to the initial 1.6%.

Consumer spending, however, rose by 3.6%, a bit lower than the initial 4% estimate, but still the largest increase since Q4 2021. This slowdown was primarily attributed to services spending.

For the first time in almost two years, residential investment increased, and at a pace much faster than initially anticipated (6.2% vs the initial 3.9%). Private inventories contributed 1.4 percentage points to growth, slightly above the previous estimate of 1.32 percentage points. Government spending also accelerated at a faster rate (5.5% vs the initial 4.6%).

Exports experienced a 6% increase (slightly lower than the initial 6.2%), recovering from a 9.3% drop in Q2, while imports saw a smaller increase of 5.2%, compared to the initial 5.7%.