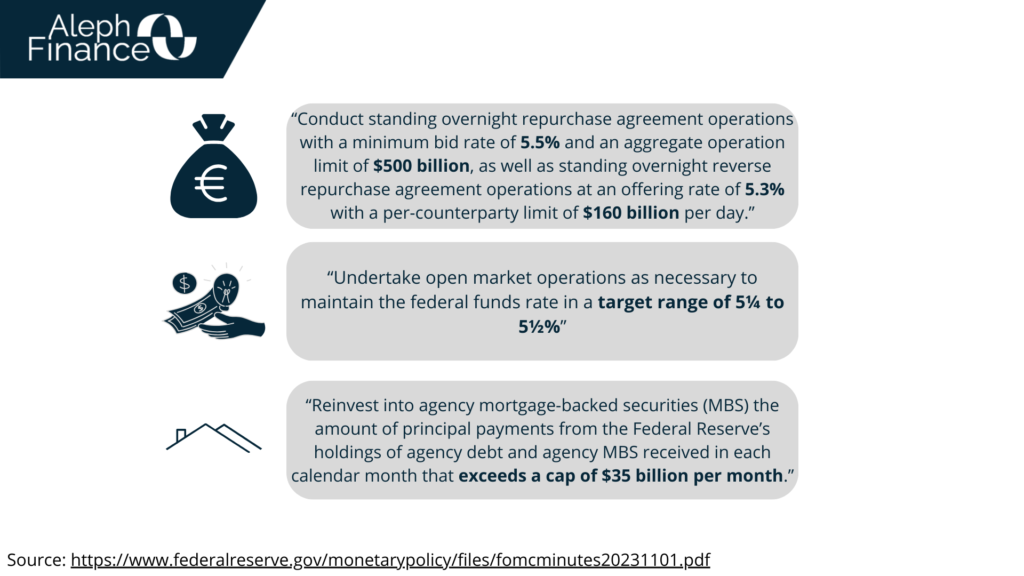

In November, the Federal Reserve kept the federal funds rate target range at a 22-year high of 5.25%-5.5% for the second consecutive time. This decision was driven by the dual goals of returning inflation to the 2% target and avoiding excessive monetary tightening. Future policy tightening will consider the cumulative impact of past rate hikes, the lagged effects of monetary policy on economic activity and inflation, and changes in the economy and financial markets. At the November 1st press conference, Powell stated that the FOMC (Federal Open Market Committee, a 12-member branch of the Federal Reserve) had not discussed rate cuts, focusing instead on potential additional rate hikes. However, any rate hikes will depend on the economy’s performance in the coming months.

FOMC decisions can indirectly influence presidential elections, as they can significantly affect the economy, which often plays a key role in voters’ decisions. Economic voting is the tendency of voters to reward or punish incumbent candidates at the polls based on pre-election economic growth. Thus, positive economic outcomes resulting from FOMC decisions could potentially benefit the incumbent candidate.

During the FOMC meeting of November 1st emerged that interest rates were raised in the last year to counter inflation and bring it back to 2%. This policy was successful in 2023, with increases stopping in July and two consecutive periods of unchanged rates between 5.25% and 5.50%. On the other hand, recent inflation data show a deceleration in the consumer price index, with a lower-than-expected increase (“Consumer price inflation remained elevated but continued to show signs of slowing”). This had raised hopes for possible rate cuts as early as May 2024, but it seems that it will not be so.

Despite this, reports indicate that the worst for the US economy may not be over yet. Inflation figures remain too high above 2%. If progress proves insufficient, the Fed may be ready to raise interest rates further.

All Fed members agree on the need to proceed with caution and maintain a restrictive policy for some time to come (unanimous vote). The bond market was confident that there would be cuts in interest rates by mid-2024, but the minutes do not confirm this expectation.

Recent economic data show a worrying slowdown in employment growth, with only 150.000 new jobs and a slight increase in the unemployment rate to 3.9%.

The next meeting of the Committee will be held on Tuesday–Wednesday, December 12– 13, 2023.