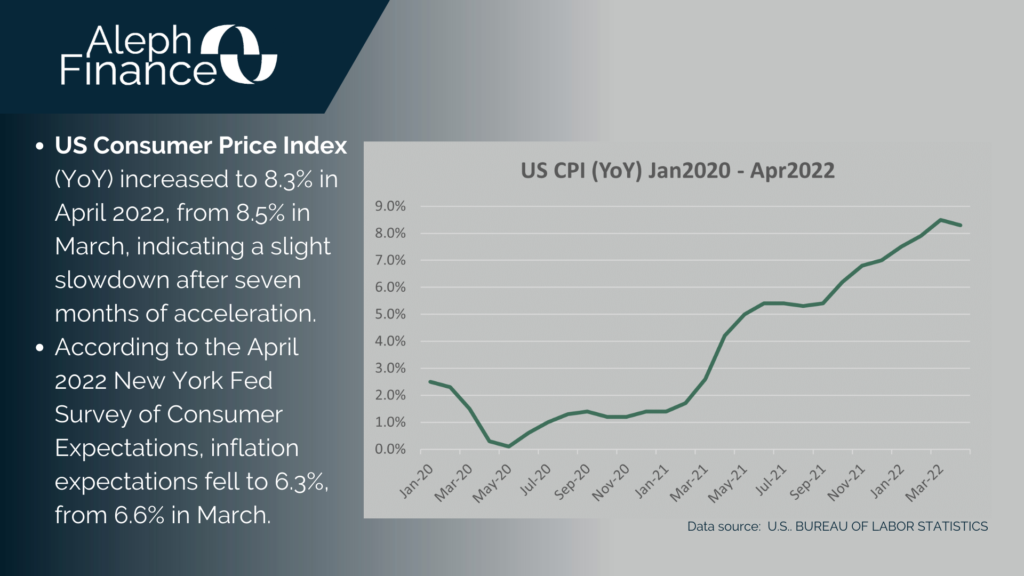

Today’s focus is on US inflation data, which are highly anticipated by market operators. The April CPI was expected to slow down, which may suggest that the peak has been reached. The inflation index was reported a week after the Federal Reserve announced a 50 basis point rate hike and a similarly sized hike at the next two policy meetings. Cleveland Fed President Loretta Mester made hawkish remarks in an interview with Bloomberg, asserting that the Fed isn’t ruling out a 75 basis point forever.

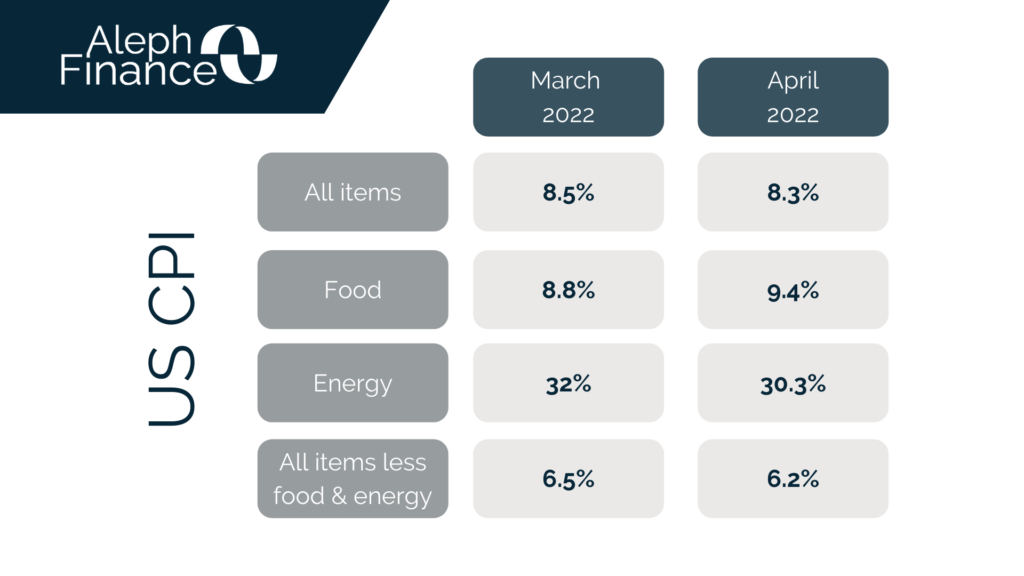

Market uncertainty has been fueled by concerns about rising interest rates, the ongoing conflict in Ukraine and lockdowns in China. Stocks advanced on Wednesday morning. Dow Jones Industrial Average futures rose 1%. S&P 500 futures were 1.2% higher, while Nasdaq 100 futures were 1.6% higher.The Consumer Price Index published by the US Bureau of Labor Statistics recorded 8.3% in April 2022, higher than the forecast of 8.1%, but below 8.5% in March. The Core CPI, which excludes the volatile food (9.4%) and energy (30.3%) categories, was 6.2%, against forecasts of 6%. The market reaction saw the stock futures drop, with major indices in the red.