Markets were dominated by inflation and growth concerns, feeding fears over the possibility of stagflation. The trigger could have been data from the US on rising labor costs combined with a sharp decline in productivity. In fact, according to the US Bureau of Labor Statistics, in the first quarter of 2022, employment cost index increased 1.4% (from 1% in the previous quarter), while labor productivity was down 7.5%, the lowest level since 1947.

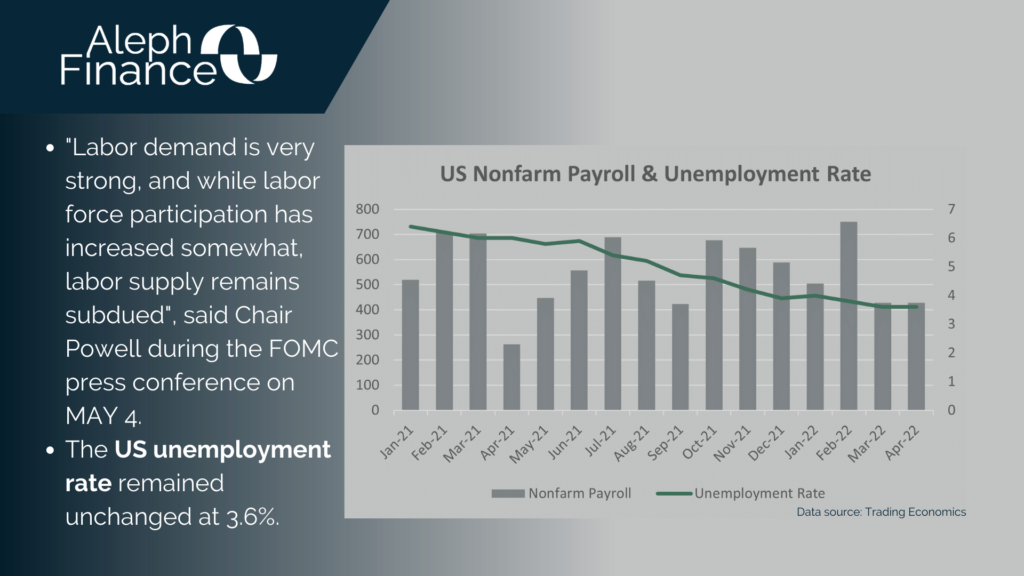

The ADP employment report released on Wednesday stated that the US nonfarm private sector added 247.000 jobs in April 2022, lower than the forecast of 395.000. Today, the focus is on the employment report released by the US Bureau of Labor Statistics. Nonfarm payrolls rose by 428.000 in April, higher than the market forecast of 391.000, but the same as the downwardly revised data of the previous month. The US unemployment rate stayed at 3.6%. In April, the average hourly wage for all employees on private nonfarm payrolls increased by 10 cents (0.3%) to $31.85.

The labor market continues to be strong, making it very unlikely for the FED to abandon its hawkish path of interest rate hikes.