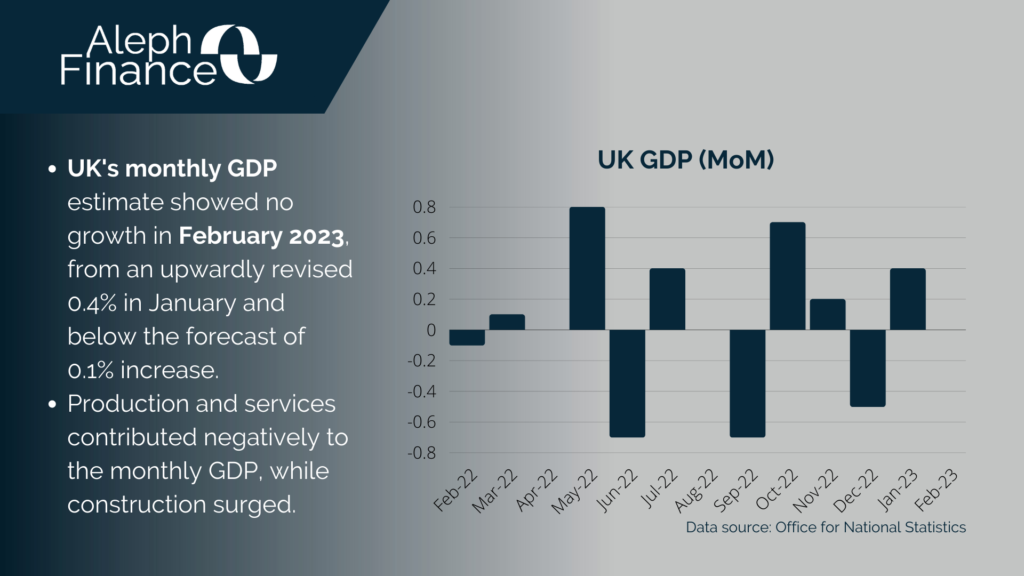

The UK economy was stagnant in February 2023 according to the Office for National Statistics (ONS) estimates. The GDP monthly report showed 0% growth, from 0.4% in January and below market forecasts of 0.1% increase. Services and production sectors both contracted in February 2023, by 0.1% and 0.2% respectively, while the construction sector grew by 2.4%. Strikes contributed adversely to the growth of services sector (-1.7% in education due to teacher strikes).

Inflation remains high, well above the Bank of England’s 2% target, and a tight labor market persists. In its fight to reduce inflation, the Monetary Policy Committee (MPC) raised interest rates eleven consecutive times, starting back in December 2021. At its monetary policy meeting in March, the central bank hiked interest rates by 25 bps, bringing the Bank Rate to 4.25%. In the Monetary Policy Summary, March 2023, it was stated that the Financial Policy Committee (FPC) assessed that the UK banking system remains resilient, which makes it capable of withstanding a period of higher interest rate.

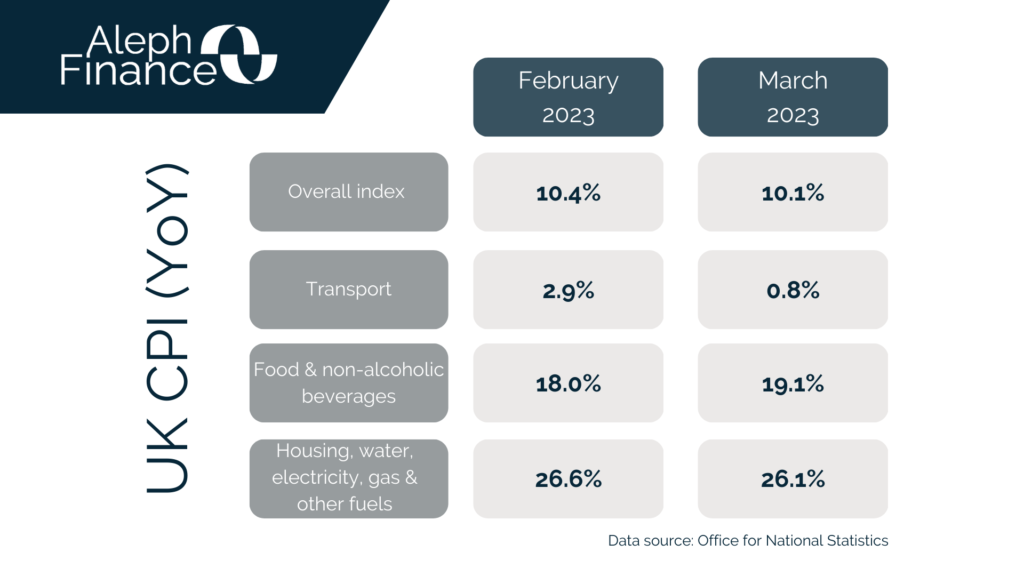

According to the ONS, the annual CPI was 10.1% in March 2023, from 10.4% in February and slightly above market forecasts of 9.8%. Core CPI remained unchanged at 6.2% in March 2023. The main driver of inflation came from the division of food and non-alcoholic beverages. With inflation still in double digits in March, another 25 bps hike is expected at the May meeting.