The Fed’s efforts in bringing inflation down to its 2% target are bearing fruit. Recent US inflation data showed that CPI cooled off to 5% year-on-year in March 2023, the lowest it has been since May 2021. The labor market also displayed signs of weakening. However, the pace at which inflation and the labor market are slowing down is likely not enough for the Fed to stop from another rate hike. Markets are pricing one last rate increase. The CME FedWatch Tool shows a higher probability of a 25 bp rate hike at the next Fed meeting in May, which will bring the funds rate above 5.00%.

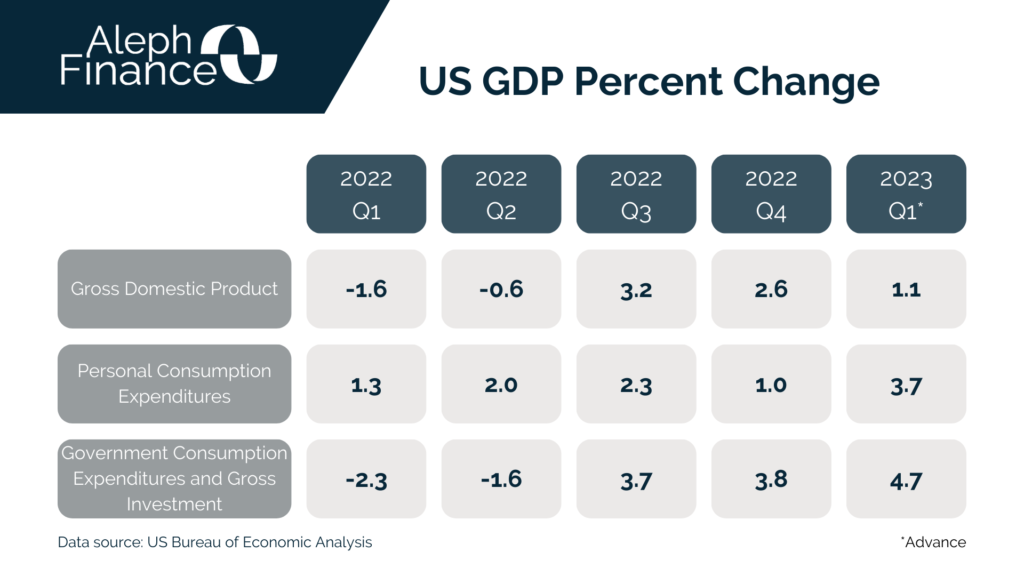

Jitteriness in the banking sector and recession fears are back. Signs of a slowdown are starting to show in the US economy. Consumer confidence in April dropped more than expected. According to the US Bureau of Economic Analysis advance estimate, in the first quarter of 2023 the GDP expanded just by 1.1%, from an annualized growth of 2.6% in the fourth quarter of 2022 and less than market expectations of 2.0%. Nevertheless, consumer spending rose 3.7% in Q1 2023, from 1.0% in Q4 2022.