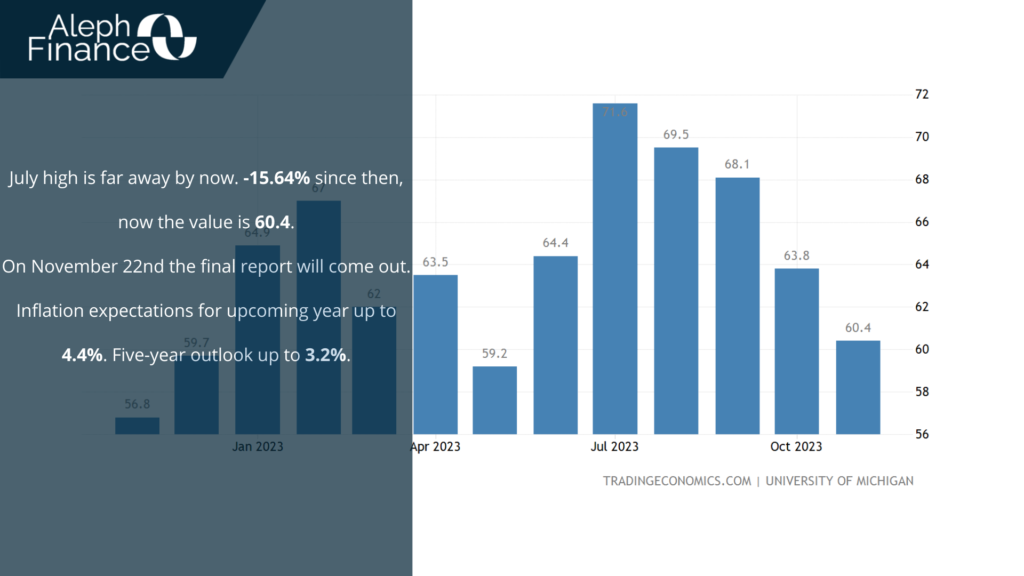

As every month, the economic landscape of the United States is significantly influenced by the Consumer Sentiment Index from the University of Michigan. On October 13th the preliminary report showed a value of the index of 63, while the consensus and the previous values were much higher (67.2 and 68.1). However, in the final report on October 27th the value was revised higher to 63.8 (consensus at 63), way far from May 2023 value, when the index plummeted to 59.2 due to pessimistic outlooks on business conditions and concerns about personal financial situations.

The significance of the Index in terms of its influence on the market is substantial. The information referenced in the reports typically provides a reliable forecast of future trends in U.S. consumer spending. Considering that consumption drives the U.S. economy, a high index implies optimistic expectations for the economic future. Thus, the Michigan Index serves as one of the promptest measures of consumer confidence.

Today, November 10th, 2023, the University of Michigan revised the consumer sentiment level at 60.4 (-5.3% M-M change), while the consensus was at 63.7. This figure is the lowest it has been since May, and consumer sentiment has been on a downward trend for four consecutive months since July high. The indicators for current economic conditions and consumer expectations also experienced a decline, falling to 65.7 and 56.9 respectively. This is largely due to the increasing apprehension about the adverse impacts of high interest rates and the persistent conflicts in Gaza and Ukraine.

In contrast, inflation expectations for the upcoming year rose for the second consecutive month to 4.4%, the highest since April. Similarly, the five-year outlook increased to 3.2% (nothing like this since March 2011). Expectations for gas prices in the short run as in the long term, have escalated to their peak levels for the year. These are preliminary estimates and are subject to change. In fact, on November 22nd the University of Michigan will spread the final report.