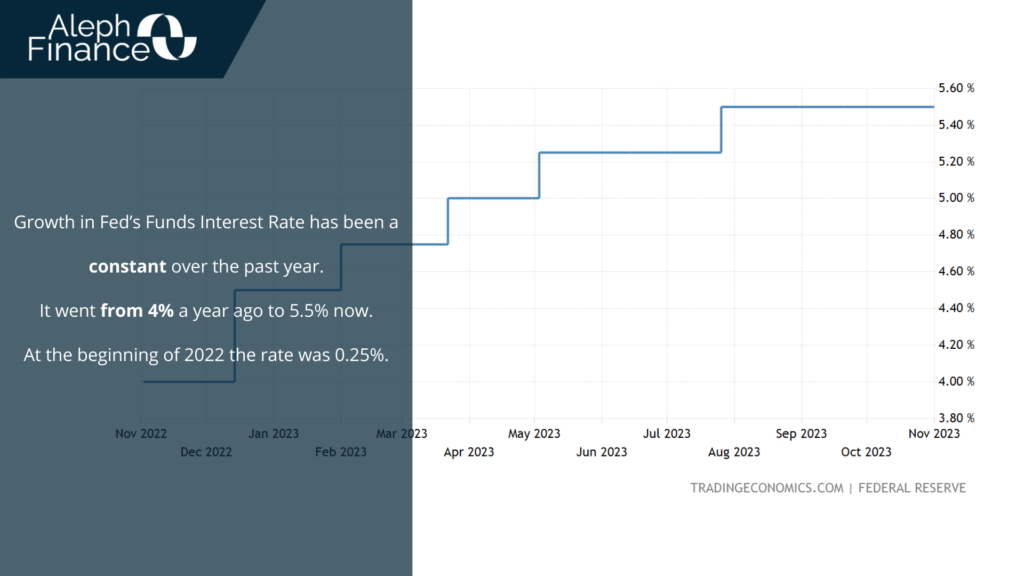

In the September 2023 meeting, the Federal Reserve decided to keep the federal funds rate target range at its 20-year high at 5.25%-5.5%. Fed Chair Powell, speaking in New York on October 19th, said the Fed is now proceeding with caution: future policy decisions will be based on a thorough analysis of incoming data, changing forecasts, and risk evaluations.

Powell recognized that the strict policy is slowing economic growth and inflation but warned that sustained high growth or a lack of job market easing could threaten inflation progress and require further monetary policy tightening. He also noted that inflation is still too high and achieving a stable 2% inflation target will likely require a period of slower growth and additional job market easing.

As expected, on November 1st, the Fed kept the interest rates unchanged, but did not rule out a possible hike in the future. The policy statement recognized the strong growth of the U.S. economy in the third quarter, but also mentioned the challenges faced by businesses and households due to higher market rates. The Fed said it would monitor economic data and inflation to decide how much more policy tightening might be needed to bring inflation back to 2%. The statement was seen as dovish by the markets, which pushed up stocks and lowered Treasury yields. Some analysts think the Fed might be done with raising rates this year.

Investors are eager to know if the Fed will stick to its plan of raising rates again, as most of its officials suggested in September. The policy statement has become more concise as officials are unsure about their next step, weighing a slow but persistent decline in inflation against a likely slowdown in the economy, and the risk of overdoing it with rate hikes. The statement also said the Fed was monitoring the delayed effects of its past rate hikes on the economy and inflation, as well as the economic and financial developments. This implies a cautious approach in deciding on further rate hikes, and a recognition that the 5.25 percentage points in rate hikes since March 2022 have not fully impacted the economy yet.

Moreover, a rise in market-based interest rates could further weaken economic growth. The statement acknowledged that tighter financial conditions were among the factors “likely to weigh on economic activity,” with unclear consequences.