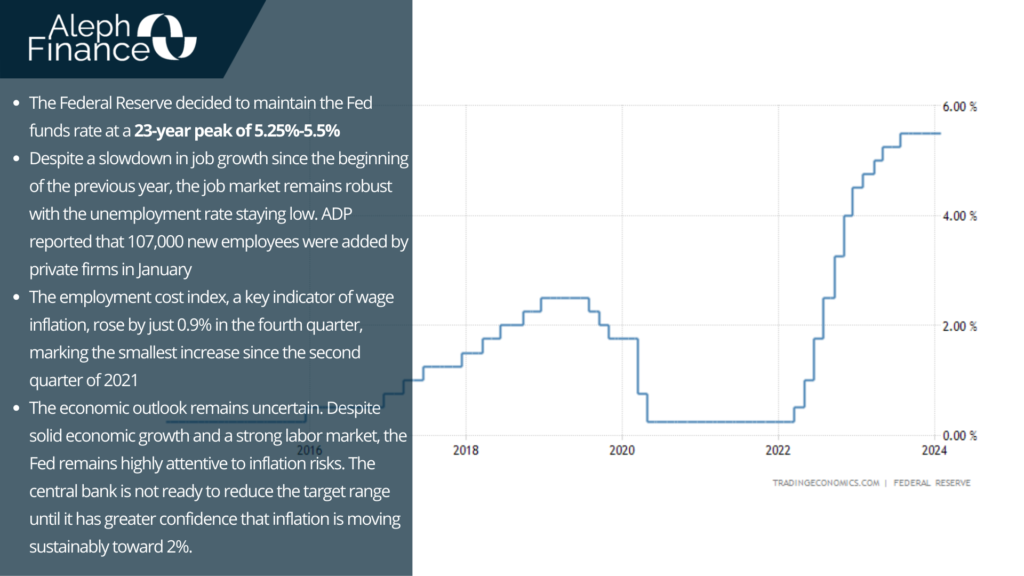

In January 2024, the Federal Reserve decided to maintain the Fed funds rate at a 23-year peak of 5.25%-5.5% for the fourth time in a row, which was consistent with market predictions. This is a mild signal that is done raising rates, but a cutting phase is not ready. Recent data points to a steady growth in economic activities. Although job growth has slowed down since the beginning of the previous year, it continues to be robust, and the unemployment rate has stayed low. “The lower inflation readings over the second half of last year are welcome, but we will need to see continuing evidence to build confidence that inflation is moving down sustainably to our goal,” FED President Jerome Powell said.

According to the statement from their meeting, the policymakers of the central bank indicated that they are not prepared to initiate rate cuts at this time. The statement indicates that “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%”. So, the FOMC (Federal Open Market Committee) has altered its statement, eliminating the wording that suggested a readiness to continue hiking interest rates until inflation is managed and is progressing towards the Fed’s inflation target of 2%.

The announcement left investors feeling uneasy, leading to a minor decline in stocks. The S&P 500 experienced a decrease of 0.9%, while the Nasdaq Composite fell by 1.4%. The Dow Jones Industrial Average also saw a marginal drop of 0.1% (before the Fed’s rate decision, S&P 500 experienced a decrease of approximately 0.7%, while the Dow Jones Industrial Average remained relatively stable, increasing by around 17 points. Among the three major averages, the Nasdaq Composite was the least performer, falling by 1.2%).

Economic growth has been solid. Inflation has decreased over the last year, yet it remains high, as also Powell said during Wednesday press conference. “The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks”, statement said. The Fed has therefore been navigating through a period of slowing inflation, a robust job market, and steady economic expansion. This situation has provided it with the flexibility to begin relaxing its monetary policy, while also maintaining vigilance about potential growth that could speed up and push prices upwards once more.

ADP (payroll processing company) disclosed that only 107,000 new employees were added by private firms in January (below market predictions), yet it still pointed to a growing labor market. In addition, the Labor Department announced that the employment cost index, closely monitored by the Fed as signs of wage-driven inflation, rose by a mere 0.9% in the fourth quarter, marking the smallest increase since the second quarter of 2021.

In a broader context, inflation, as tracked by the core personal consumption expenditures prices, increased by 2.9% in December, the lowest rate since March 2021. Over a six- and three-month period, core PCE prices were either at or below the Fed’s target.