During its inaugural gathering of 2024, the European Central Bank (ECB) decided to maintain its record-high interest rates, as it was expected. The bank committed to keeping these rates at levels that are adequately stringent until inflation returns to its 2% objective promptly. During the press conference that follows the press release, President Lagarde said “We are determined to ensure that inflation returns to our 2% target in the near future. We will continue to follow a data-dependent approach”. This decision was made despite the potential threat of an economic downturn and a slow reduction in inflationary trends. In the press conference she also said that everyone in the meeting agreed that it was premature to discuss rate cuts, as these depend on data and not on a date on the calendar.

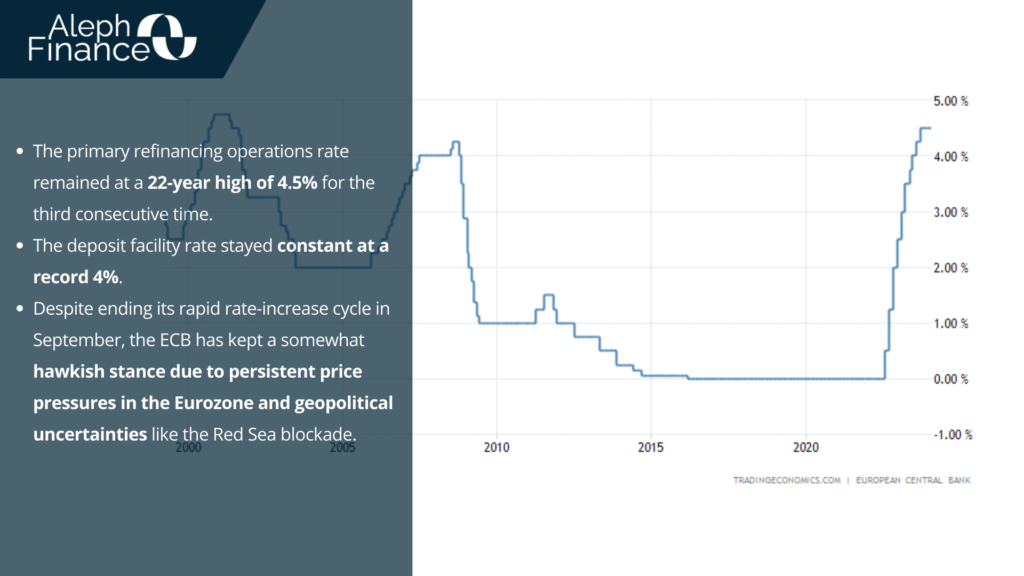

In the official press release on Jan. 25th’s monetary policy decision, some optimism emerged about inflation developments in the medium term. The reference rates remain fixed at 4.50%, 4.75% on marginal loans and 4% on bank deposits. In recent days, participating in the World Economic Forum in Davos, she announced that the cost of the money would remain firm “until the summer”. The ECB also reiterated that each decision will be dependent on data and that Quantitative Tightening, the gradual decrease in bond purchases, continues.

The primary refinancing operations rate persisted at a 22-year peak of 4.5% for the third time in a row, while the deposit facility rate remained constant at an unprecedented 4%. Despite concluding its swift rate-increase cycle in September, the ECB has maintained a slightly aggressive posture due to ongoing intrinsic price pressures in the Eurozone and uncertainties arising from geopolitical conflicts, such as the blockade in the Red Sea.

During the press conference President Lagarde also stated that the economy is likely to stagnate at the end of 2023, but that there are signals indicating a recovery in growth. She also specified that maximum attention is needed on what is happening in the Middle East and Red Sea. For the moment, there are no repercussions, but the scenario can change and raw materials and energy are involved.

On the other side of the ocean, the Bureau of Economic Analysis shared new data on US GDP growth rate. In the final quarter of 2023, the US economy saw an annualized growth of 3.3%, surpassing market predictions of a 2% increase and following a 4.9% rate in the third quarter, as expected. This growth was driven by rises in consumer expenditure, exports, spending by state and local governments, nonresidential fixed investment, federal government expenditure, private inventory investment, and residential fixed investment. There was also an increase in imports.

Looking at the entire year of 2023, the US economy experienced a growth of 2.5%, in comparison to 1.9% in 2022 and the Federal Reserve’s projection of 2.6%. As the data show, the Federal Reserve’s monetary tightening strategy had an impact on the economy, but the effect was less drastic than initially expected, thanks to a robust labour market that continues to bolster consumer spending.