Last week the focus was on the ECB raising its three key interest rates by 50 basis points. This week it’s the Federal Reserve’s turn. Days prior to the Fed’s policy statement, markets were pricing in another 75 basis point increase in the benchmark rate, same as at the June meeting. Just before the release of the rate decision, the CME FedWatch Tool was showing a 78.7% probability for a 75 basis point increase.

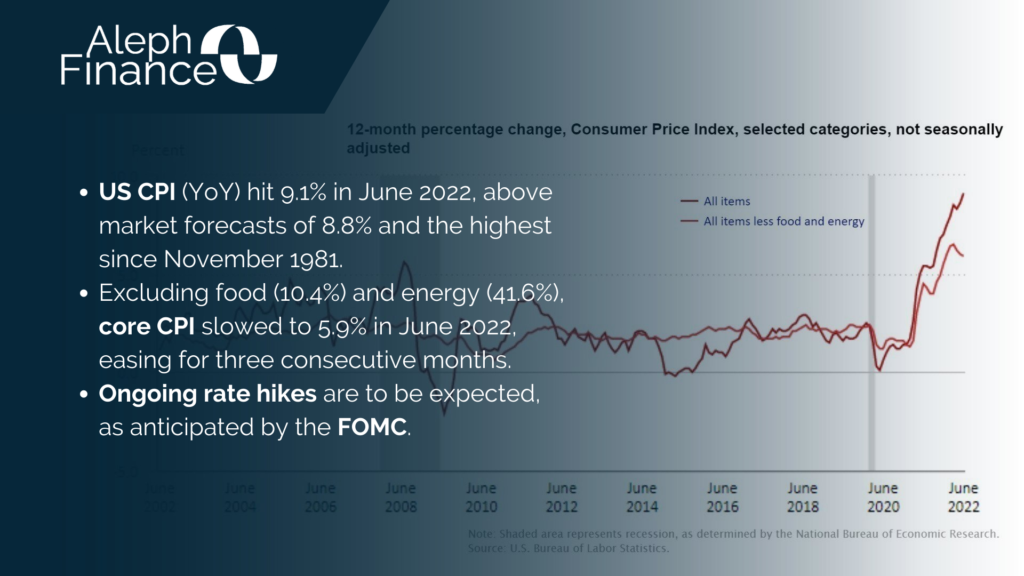

Such expectations were confirmed at the July 27 Fed meeting. The FOMC raised the funds rate by 75 basis point, bringing the benchmark to a target range of 2.25% to 2.50%. This marks the fourth consecutive rate hike in 2022 by the central bank (+25 bp in March, +50 bp in May, +75 in June, +75bp in July) as they try to bring soaring inflation down to its 2% target. Fed Chair Powell reiterated their firmness to restore price stability. But he also stated that “it likely will become appropriate to slow the pace of increases” at some point depending on the evolving economic outlook. Chair Powell also said that he doesn’t think that the US is in a recession right now as the labour market continues to be strong.

Discouraging data came from the macro front ahead of the Fed conference. According to the US Census Bureau, new residential sales dropped by 8.1% month-over-month in June 2022. The CB consumer confidence index also disappointed, standing at 95.7 in July, down from 98.4 in June. The International Monetary Fund further cuts its world GDP projections for 2022 (3.2% in July from 3.6% in April) and 2023 (2.9% from 3.6%), as the global economic outlook turns “gloomy and more uncertain”. The downward revision can be attributed to high inflation worldwide, slowdown in China and the war in Ukraine. Still on the growth front, the advance reading of US GDP for the second quarter of 2022 will be out later today and the forecast points to an annualized growth of 0.5%. The Fed is closely watching incoming macroeconomic data to assess the pace of next increases.