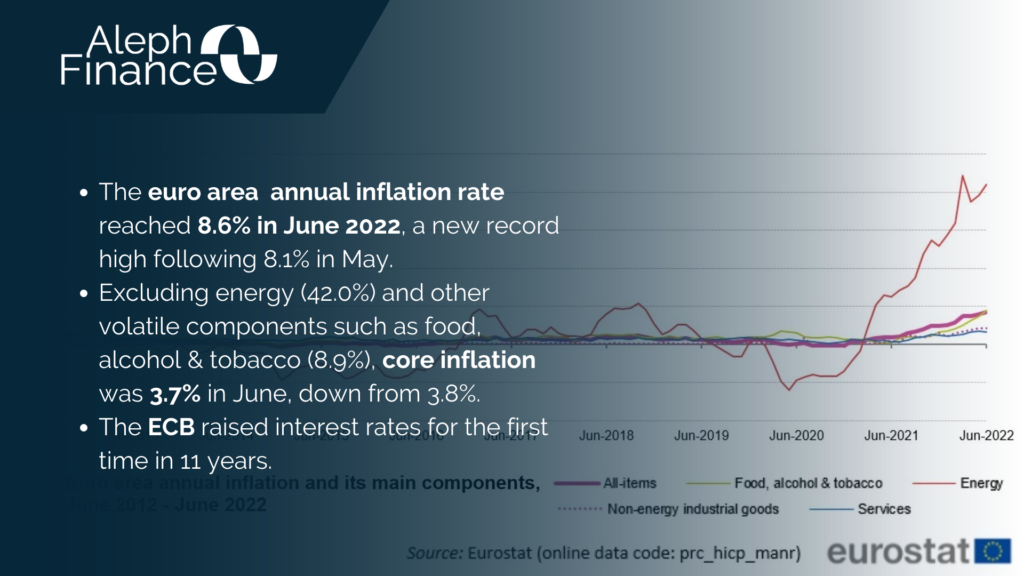

Europe is in a pressing situation. Inflation is running high as the war in Ukraine persist, exacerbating the rise in prices, especially energy and food. CPI in the euro area increased to an all-time high of 8.6% in June 2022. Italy is facing another government crisis with the resignation of Prime Minister Mario Draghi, paving the way for early elections. PM Draghi’s formal resignation came Thursday morning after a failed attempt to restore the coalition. In addition to political uncertainty in Italy, concerns are high about the possibility of a total cut in Russian gas supply to Europe, despite the Nord Stream 1 pipeline resuming gas flows on Thursday after the 10-day stop for maintenance. The European Commission has proposed an emergency plan to reduce gas consumption by 15% from 1 August 2022 to 31 March 2023 on a voluntary basis, but it could become mandatory.

Central banks around the world are significantly raising interest rates as they are determined to bring inflation down. Today the focus is on the European Central Bank which announced a first rate hike in 11 years, as anticipated in the June meeting. Before the ECB monetary policy statement, markets were considering the possibility of a 50 basis point hike at the July meeting, outstripping the official guidance which was for a 25 basis point hike.

The Governing Council raised the key ECB interest rates by 50 basis points at its July meeting. Now the focus is all on the anti-fragmentation tool which is expected to be unveiled today. Just 4 days away from the 10th anniversary of Draghi’s “whatever it takes” statement, Lagarde position is under the spotlight.

Market reaction after the publication of the interest rate favour the common currency with EURUSD up at 1.0240 while indices are little moved to the upside after a weak start.