The week began with hawkish remarks from US central bankers. On Monday, Chair Powell said that the FED will be ready if needed to take an even more aggressive stance to tame inflation. Such statement has shaken the markets and caused the 10-year US Treasury yield to reach a new multi-year high (above 2.41%) on Wednesday. On the other side of the Atlantic President Lagarde said in Paris that the ECB and the FED will fall out of sync. As the Russia-Ukraine war has a very different impact on the Eurozone economy, a more dovish approach is required from the ECB as Europe is more exposed to the war.

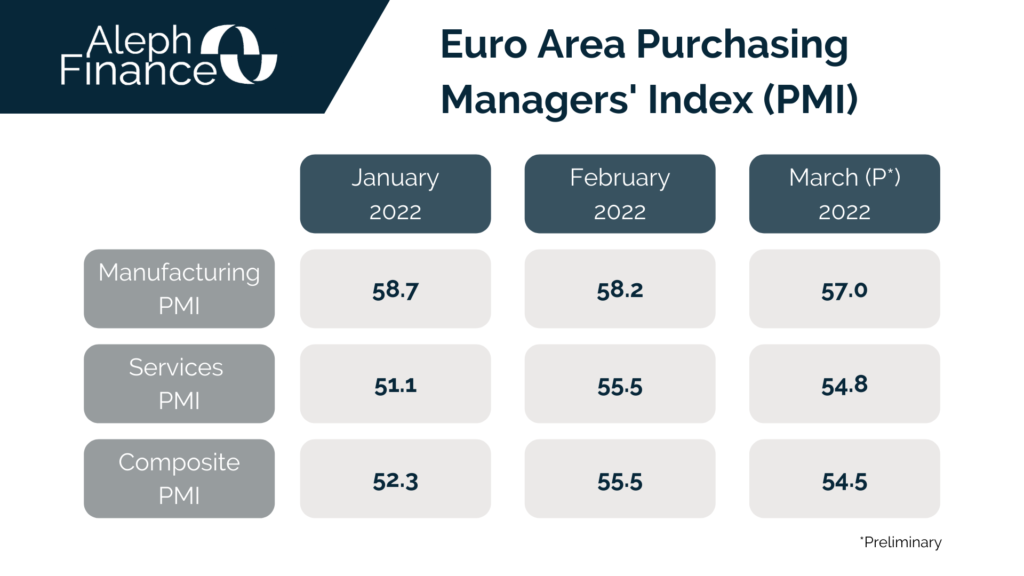

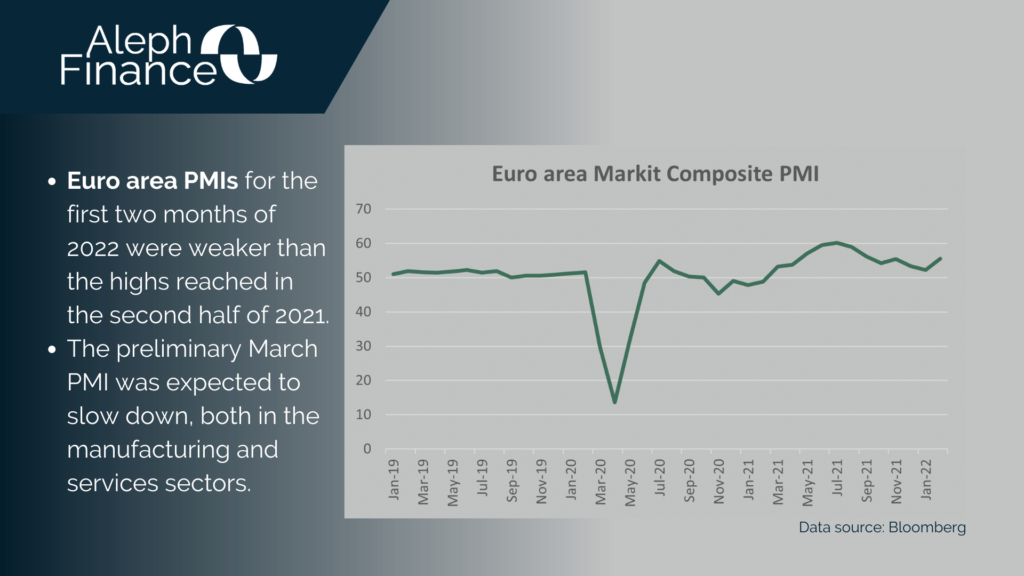

Today, on the macro front, the focus was on PMIs which incorporate the first effects of geopolitical escalation, rising inflation and increasing covid-19 cases. Data published by IHS Markit shows that the preliminary euro area composite PMI decreased to 54.5 in March, down from 55.0 in February and slightly above the market forecast of 53.9; manufacturing PMI dropped to 57.0 from 58.2; services PMI fell to 54.8 from 55.5. Decline has been somewhat moderate hinting EU GDP is still expected to expand in 2022.

After the publication of these data, the focus shifts to the NATO summit in Brussels that will see the participation of President Biden. Ahead of the meeting, European stock markets were slightly up on Thursday morning.