The Russia-Ukraine war continues to be the focus of global dynamics. Adding pressure to an already uncertain environment is the return of the increase in covid cases as the omicron subvariant spreads rapidly in many countries. The covid outbreak in China has poised the government to put millions of people under lockdown. This led to a halt in manufacturing causing in part the reduction in crude oil prices (below 100$/b).

Awaiting the Fed’s decisions and economic projections, markets on Wednesday morning were positive: the pan-European Stoxx 600 index was up 2.2%, with all sectors in the green; the Dow Jones Industrial Average futures was up 359 points or 1.1%, the S&P 500 futures followed up 1.2% and the Nasdaq 100 futures was similarly up 2%.

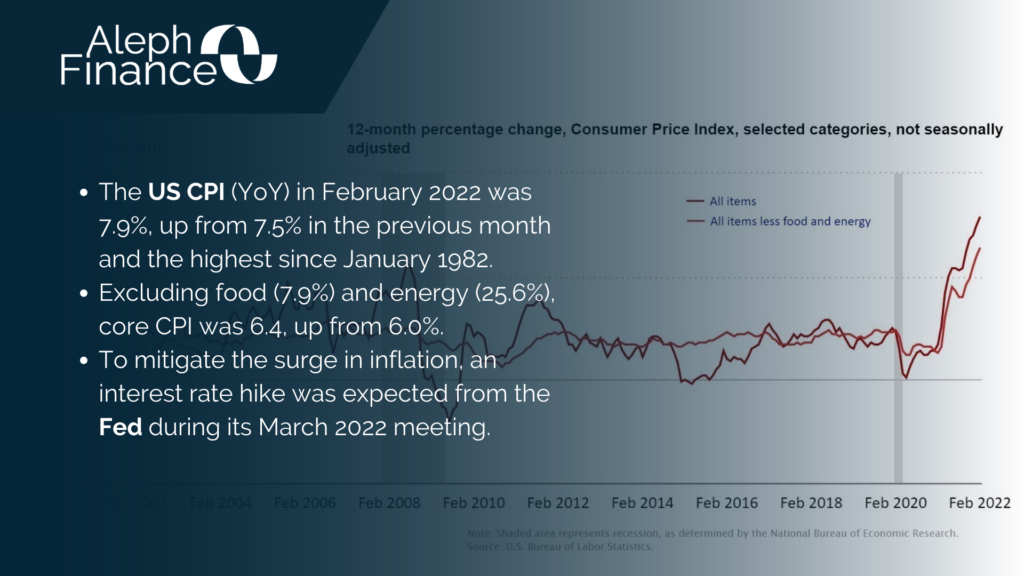

FED Chairman Powell announced a 25 basis point rate hike from 0.25% to 0.5% stating that the American economy is strong enough to sustain tighter monetary policy. February inflation was 7.9%, far above the central bank’s 2% target. “The goal is to restore price stability while also sustaining a strong labour market,” said Powell. The FOMC lowered its 2022 US GDP forecast from 4% to 2.8%, mentioning as the main factor the Ukrainian war. On the other hand, inflation projection in 2022 was revised upwards to 4.3%. On Thursday morning, after the Fed’s hawkish stance, Dow Jones Industrial Average futures fell 20 points, or less than 0.1%, while S&P 500 and Nasdaq-100 were just below the flatline.