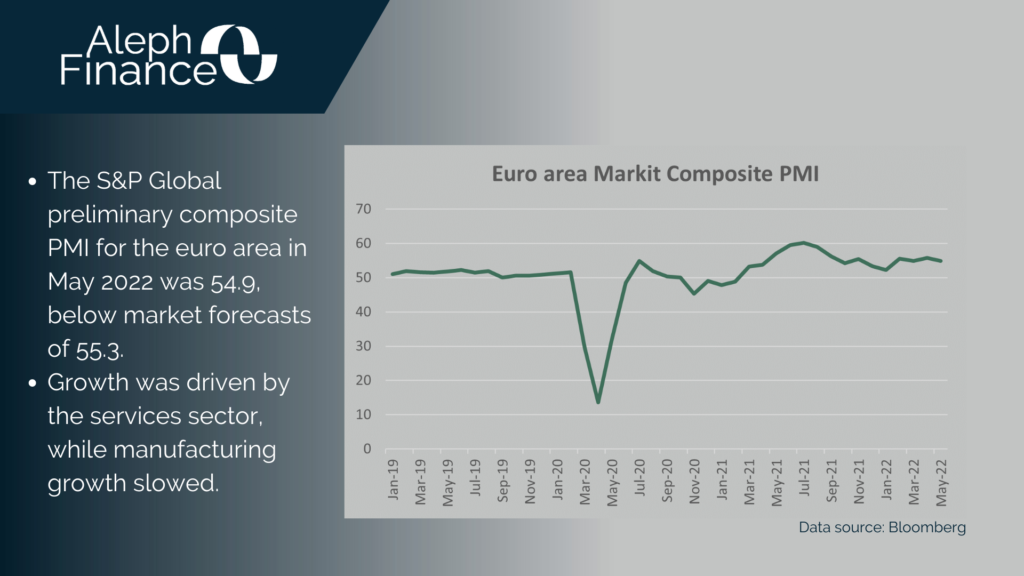

Concerns about inflation and growth continue to be the major concern of investors. Important data to keep an eye on, therefore, is the Purchasing Managers’ Index (PMI), published today by IHS Markit (S&P Global). The extent to which the war in Ukraine and lockdowns in China are causing supply chain disruptions and increasing inflationary pressures are reflected in the index.

Inflation in the euro area remained at a record high of 7.4% in April 2022 and more than three times the ECB’s target of 2%. High energy and food prices continued to be the main driver, exacerbated by the Russia-Ukraine war and supply constraints due to the pandemic. “Based on the current outlook, we are likely to be in a position to exit negative interest rates by the end of the third quarter,” President Lagarde said on Monday in The ECB Blog.

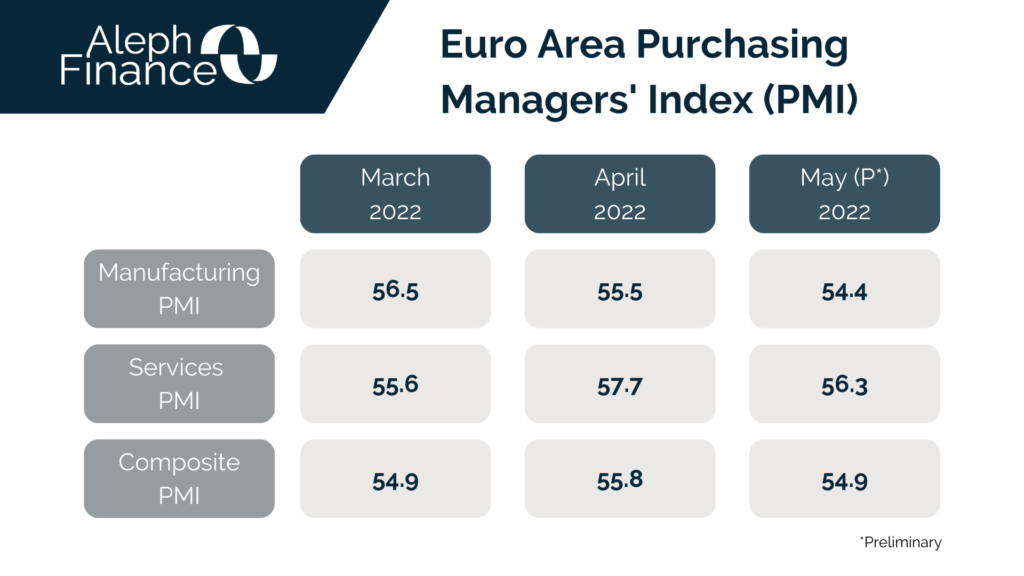

The S&P Global preliminary euro area composite PMI fell to 54.9 in May, down from 55.8 in April and below the market forecast of 55.3. Manufacturing PMI decreased to 54.4, slightly below the forecast of 54.9. Services PMI fell to 56.3, well below the forecast of 57.5. The services sector drove growth as the economy reopened following covid-related restrictions, particularly for tourism and recreation.