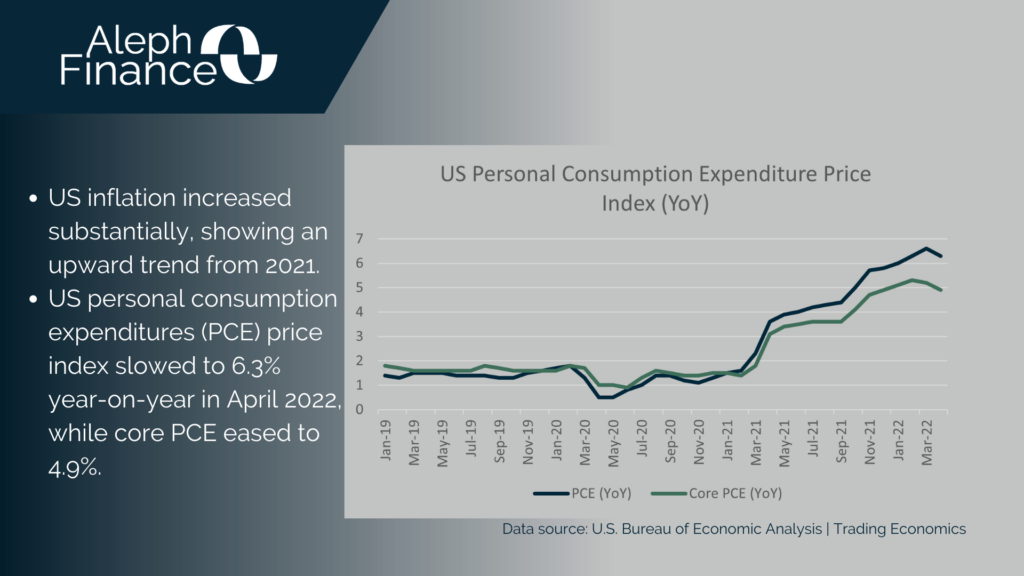

Today, on the macro front, the Personal Consumption Expenditures (PCE) Price Index was released by the US Bureau of Economic Analysis. This key indicator is the Fed’s preferred gauge to measure inflation. According to the Fed’s latest minutes published Wednesday, “the staff’s projection for PCE price inflation was revised up slightly in the second half of 2022 and in 2023”. Moreover, FOMC members confirmed their aggressive stance by assessing that rate hikes of 50 basis point are very likely at their next two meetings.

Disappointing news came from the second estimate of the US GDP, as it declined at an annual rate of 1.5% in the first quarter of 2022, worse than the advance reading of -1.4% and the forecast of -1.3%. The contraction in economic growth was mainly attributed to the Omicron variant and the cutback on government assistance.

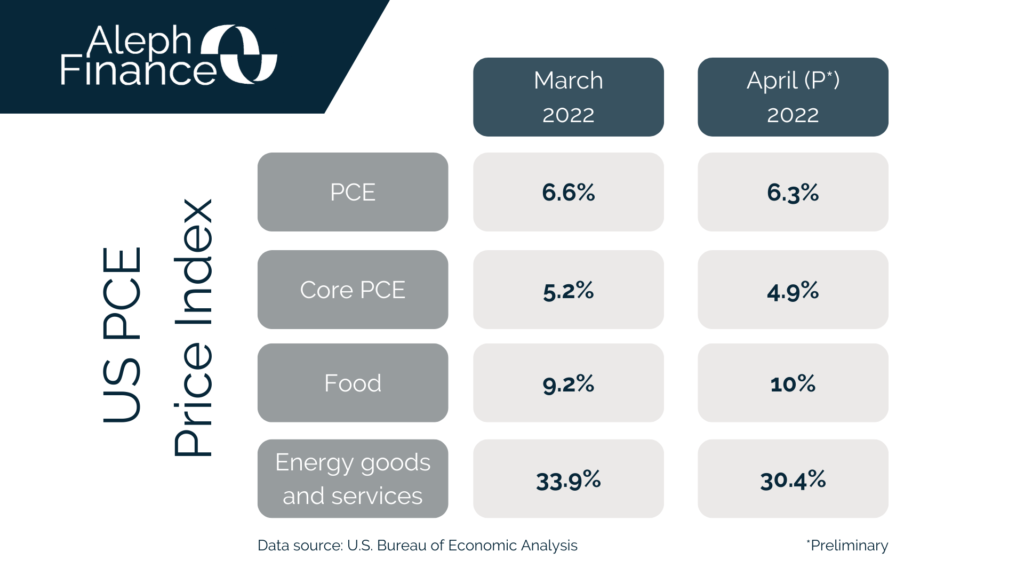

In April 2022, US Consumer Price Index (CPI) slowed to 8.3% year-on-year but the return to pre-pandemic levels is not yet on the horizon, as supply disruptions and high food and energy prices persist. The Russia-Ukraine war has exacerbated these problems caused by the pandemic. The headline PCE price index, on the other hand, slowed to 6.3% year-on-year in April 2022, from a 6.6% record high in March. Core PCE price index was 4.9% in April from 5.2% in March. Food increased to 10% from 9.2% in the prior month, while energy goods and services eased to 30.4% from 33.9%.