The geopolitical crisis, the most serious since the post-WWII, continue to be the main concern this week. European stocks have been volatile this morning as the conflict between Russia and Ukraine continues. Brent crude futures raised above $110 per barrel, reaching their highest level in seven years and fuelling fears of supply shortages. Amid current situation, there is growing skepticism over central banks’ plan to accelerate their tapering plan as the risks associated with the conflict heighten uncertainty. Such move is poised to calm the markets at least for now.

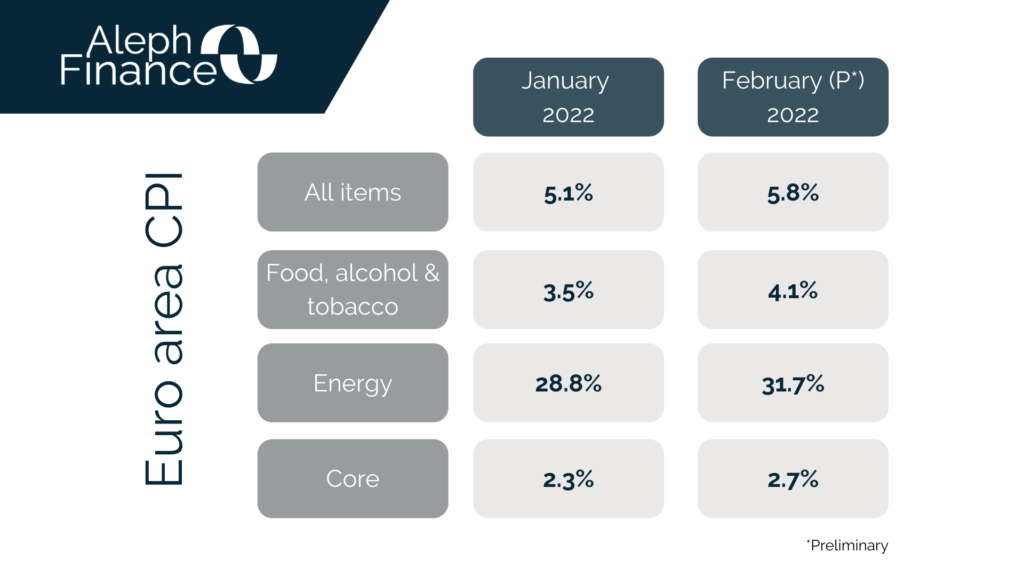

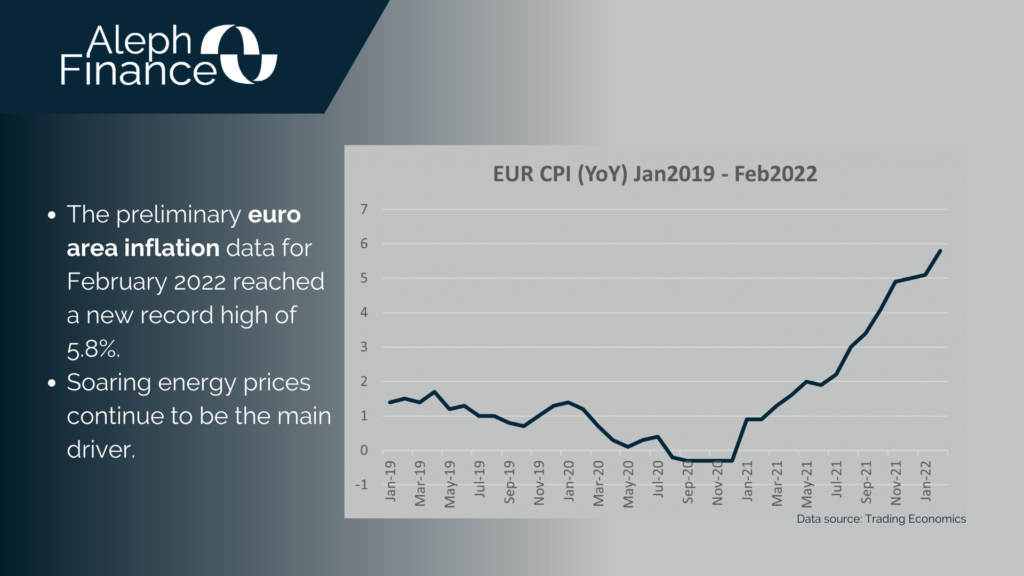

On the macroeconomic front, today the focus is on the release of preliminary euro area inflation data for February, which reached a new record high of 5.8%, well above the 5.1% in January and the market expectation of 5.4%. The biggest price hike remains energy at 31.7%, followed by food, alcohol and tobacco at 4.1%. The data, still more than double the ECB’s 2% target, adds to the Central Bank’s dilemma of responding to increasing price pressures as they tackle market turmoil caused by the geopolitical conflict.