On 24 January 2020, we registered the first confirmed Covid 19 case in Europe. That day signs the beginning of one of the most complex periods of the European Economy. The lockdown, in fact, put a lot of pressure on the economy in general and more particularly on the small and medium enterprises which started crumbling as the demand for their goods and services dropped significantly.

We will now go through the different Monetary Policies that the ECB took during this period.

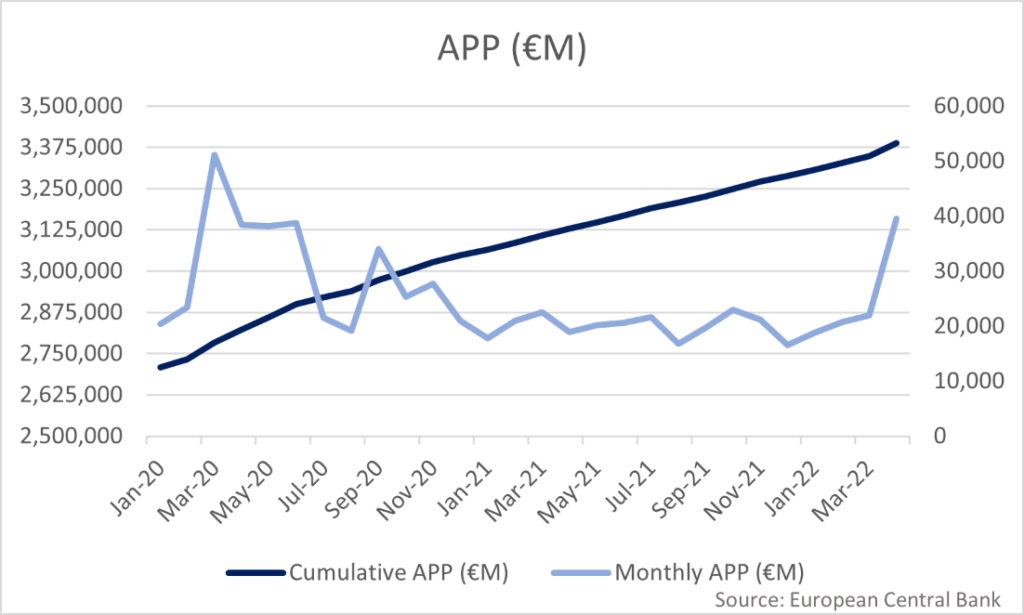

APP

The Asset Purchase Program started at the end of 2014. During the pre-pandemic period, net purchases totalled €20 billion per month. They are expected to end shortly before they start raising the key ECB interest rates. On 12 March 2020, it has been announced that until the end of the year, a €120 billion temporary envelope of extra net asset purchases will be introduced, ensuring a robust contribution from private sector purchase programs. In times of increased uncertainty, this will help to support favourable financing conditions for the real economy. On the same day, it has been announced that the reinvestments of principal payments from maturing securities acquired under the APP will proceed in full for a long time after the Governing Council begins raising key ECB interest rates, and in any case for as long as needed to keep advantageous liquidity conditions and a sufficient level of monetary accommodation. On 16 December 2021, president Lagarde announced that in accordance with a gradual reduction in asset purchases and to maintain a monetary policy stance consistent with inflation The Governing Council decided on a monthly net purchase pace of €40 billion in Q2 and €30 billion in the Q3 under the APP to preserve its medium-term goal. Starting in October 2022, the Governing Council will buy net assets under the APP at a monthly rate of €20 billion to maintain the accommodating effect of its policy rates for as long as necessary. Later, on 10 March 2022, the ECB announced that the calibration of net purchases for the third quarter will be data-dependent and reflect its evolving assessment of the outlook. If the incoming statistics support the view that the medium-term inflation outlook would not deteriorate once the Fed’s net asset purchases are completed, the Governing Council will conclude net purchases under the APP in the Q3.

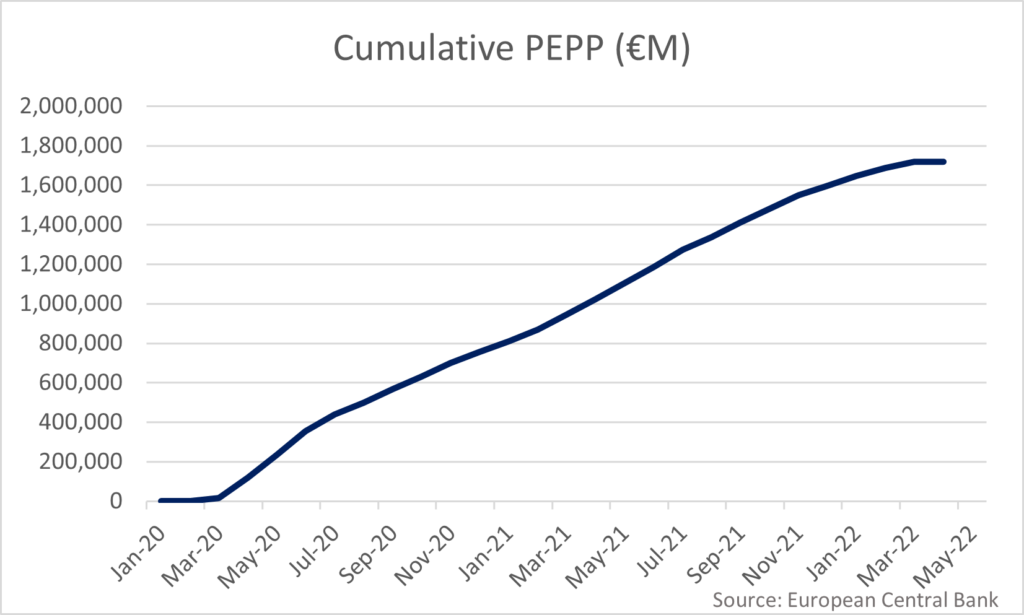

PEPP

On 18 March 2020, the Governing Council decided to introduce a temporary asset purchase program of private and public sector securities to rebut the serious risks to the euro region’s monetary policy transmission mechanism, as well as the euro area’s prospects, posed by the outbreak and rising spread of the coronavirus, COVID-19. The new PEPP (Pandemic Emergency Purchase Program) will have a budget of €750 billion. Purchases will be made until the end of 2020, and will include all asset categories that are currently eligible for the asset acquisition program (APP). On 4 June 2020, the Governing Council decided that the envelope for the pandemic emergency purchase programme (PEPP) will be increased by €600 billion to a total of €1,350 billion and that the horizon for net purchases under the PEPP will be extended to at least the end of June 2021. To Conclude, it also announced that the maturing principal payments from securities purchased under the PEPP will be reinvested until at least the end of 2022. On 10 December 2020, the Governing Council decided to increase the envelope of the pandemic emergency purchase programme (PEPP) by €500 billion to a total of €1,850 billion. The PEPP’s net purchasing horizon was also extended until at least the end of March 2022. In any case, the Governing Council will continue to make net purchases until the coronavirus crisis has passed. It also decided to extend the reinvestment of principal payments from maturing securities purchased under the PEPP until at least the end of 2023. On 16 December 2022, it has been announced that at the end of March 2022. The PEPP’s reinvestment horizon has been extended by the Governing Council. It now plans to reinvest principal payments from maturing securities purchased through the PEPP until at least 2024.

TLTRO III

On 12 March 2020, the ECB announced that in TLTRO III, significantly more advantageous terms will be applied to all TLTRO III operations outstanding for the period June 2020 to June 2021. Small and medium-sized businesses, in particular, are being targeted. The interest rate on these TLTRO III operations will be 25 basis points lower than the Eurosystem’s major refinancing initiatives. As of February 28, 2019, the maximum total amount that counterparties can borrow in TLTRO III operations has been increased to 50% of their eligible loan stock. The criteria for the targeted longer-term refinancing operations (TLTRO III) were reduced further on April 30, 2020. The Governing Council resolved to lower the interest rate on TLTRO III operations by 50 basis points between June 2020 and June 2021, compared to the average interest rate on the Eurosystem’s main refinancing operations over the same period. On 10 December 2020, the ECB decided to recalibrate the conditions of the third series of targeted longer-term refinancing operations (TLTRO III). Extend the time during which significantly better terms will apply by a year, until June 2022. Increase the total amount that counterparties will be able to borrow in TLTRO III operations from 50% to 55% of their qualifying loan stock.

PELTROs

A new round of non-targeted pandemic emergency longer-term refinancing operations (PELTROs) will begin on April 30, 2020, to help with liquidity. Beginning in May 2020 and maturing in a staggered order from July to September 2021. They will be conducted as full allotment fixed rate tender procedures with an interest rate that is 25 basis points lower than the average rate on the main refinancing operations for the term of each PELTRO.

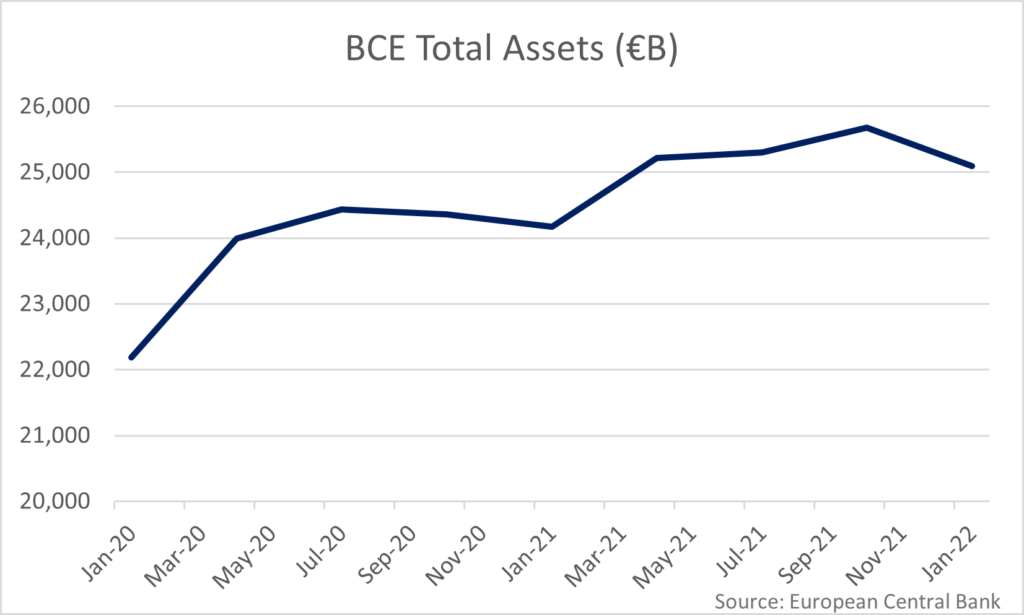

These expansionary monetary policies characterized by a strong quantitative easing had a strong effect on the Balance Sheet of the ECB.

Looking at the graph, it is easy to notice that since January 2020, the total asset of the ECB had a critical boost. In fact, it grew from €22185B to € 25093B, registering an increase of 13% in just two years. The graph shows that the period where the asset grew more rapidly is between January 2020 and May 2020. In this period in fact we witnessed the introduction of the PEPP and the increase in the APP. Also, the second crucial boost of December 2020 happened as the PEPP was extended to €1850B.

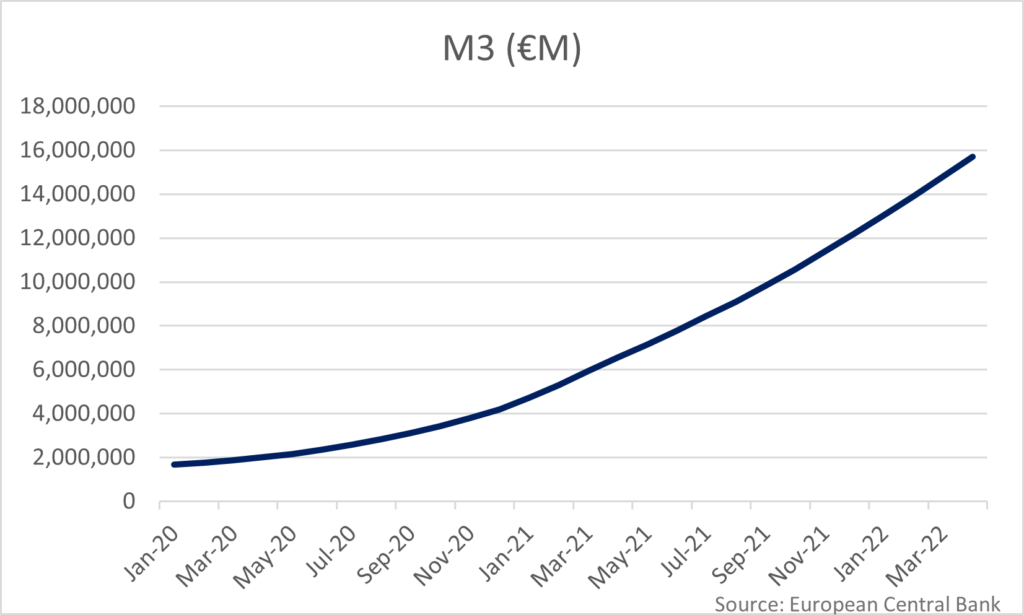

It goes without saying that this Monetary Policy increased Money Supply, as a tracker of it we used M3.

It is clear that during the pandemic period the M3 has been exponentially growing, thanks to the massive quantitative easing carried out by the ECB.

Inflation

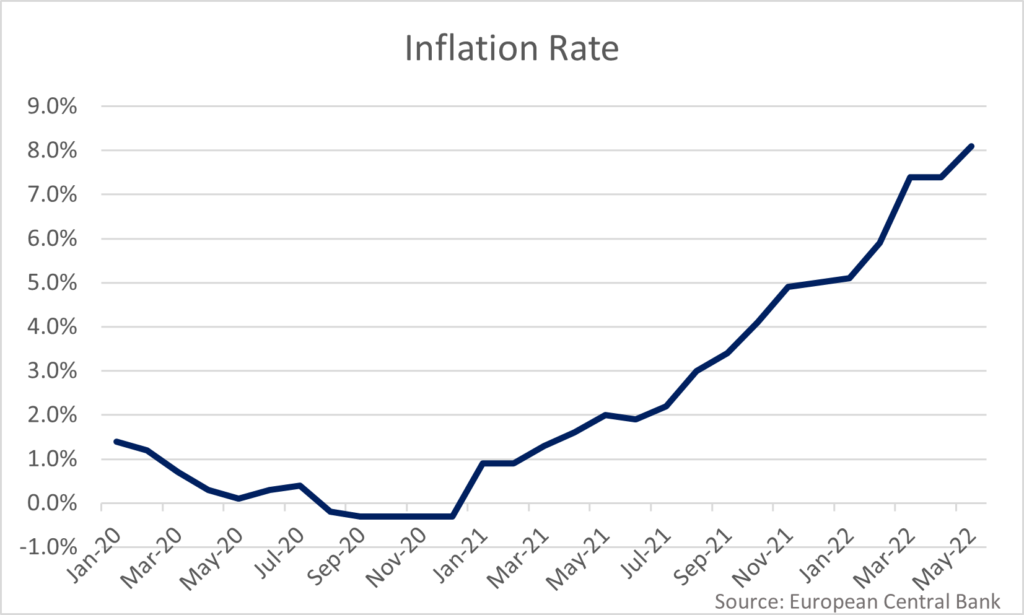

On 22 July 2022, for the first time since the pandemic period, during the Monetary Policies decision press release, president Lagarde mentioned that they were expecting a transitory period in which inflation would have been moderately above target (2%). As time passed the idea that inflation was just transitory started to lose consensus. On 2 February 2022, Lagarde communicated that inflation was not as temporary as previously thought, in fact during the press conference she said things like, “Inflation is likely to remain elevated for longer than previously expected but to decline in the course of this year”, “Inflation increased to 5.1 percent in January, from 5.0 percent in December 2021. It is likely to remain high in the near term” and “Compared with our expectations in December, risks to the inflation outlook are tilted to the up-side, particularly in the near term. Inflation could be higher if price pressures lead to larger-than-expected wage increases or the economy returns to full capacity more rapidly.

Especially after the war in Ukraine started, the European economy suffered. New shortages of resources and inputs are emerging as a result of trade disruptions. Demand is being stifled by rising energy and commodity prices, which are limiting output. Inflation has risen sharply and will continue to do so in the coming months, owing primarily to the rapid spike in energy expenses. Inflationary pressures have increased in a number of areas.

Expectation for Thursday

The markets feel strongly about Lagarde increasing interest rates. Investors have priced in a 37.5 basis point tightening in the central bank’s rate by next month’s meeting, meaning a 50% likelihood of a half-percentage point hike, the first since 2000. Sensing the urgency, Bank of America strategists forecast last week that the ECB will raise rates by half a point in July and September, followed by two quarter-point hikes in the final two policy meetings of the year. In Slovenia, on 11 May 2022, Lagarde said “My expectation is that they (APP) should be concluded early in the third quarter,” and “The first-rate hike, informed by the ECB’s forward guidance on the interest rates, will take place sometime after the end of net asset purchases. We have not yet precisely defined the notion of “some time”, but I have been very clear that this could mean a period of only a few weeks”. Lagarde’s comments show that she agrees with an increasing number of governing council members who are calling for a 25-basis-point increase in the ECB’s deposit rate at the July 21 policy meeting. On Wednesday, UBS’ Reinhard Cluse anticipated that a 25-basis-point hike in July would be the first of seven such increases by the end of the year, bringing the deposit rate to 1.25 percent.