The ECB’s long-awaited monetary policy decision was out today All eyes were focused on what President Lagarde said during the press conference.

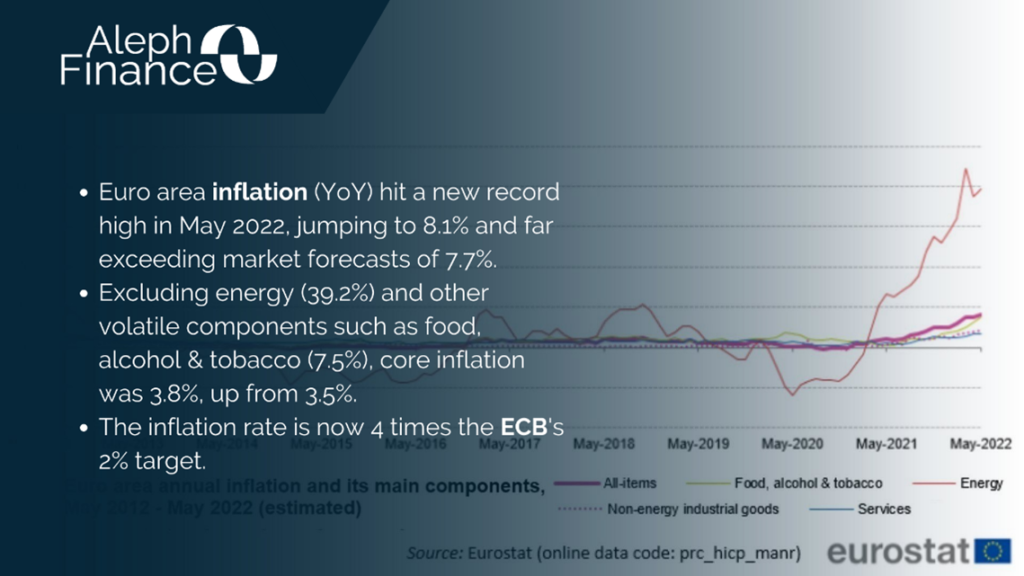

Inflation continues to remain high, reaching an annual rate of 8.1% in May 2022. The price increase is mainly driven by the Russia-Ukraine war and pent-up demand following the Covid-19 pandemic. This situation is putting the central bank under pressure as they fight to tame inflation and bring it down to its 2% target. A further challenge for the ECB is the issue of financial fragmentation. The 10-year spread between Italian and German bonds is above 200 points.

As inflation remains persistently high, banks are revisiting their expectations of ECB rate hikes. According to a Reuters article, BofA Securities increased its forecast from 100 bps to 150 bps by the end of the year, while Barclays is now expecting a hike of 25 bps at every meeting from July to December.

As expected, the ECB maintained the interest rate unchanged at 0%, the marginal lending facility rate at 0.25% and the deposit facility rate at -0.5%. The Governing Council stated that it will end net asset purchases on July 1, 2022, and confirmed that it intends to raise interest rates by 25 basis points at its July meeting. A September rate hike is also expected but the scale will depend on the mid-term inflation outlook.

Macroeconomic projections by the ECB staff were also released today. Annual inflation projections have been raised to 6.8% in 2022, 3.5% in 2023, and 2.1% in 2024. The growth forecast, on the other hand, was lowered to 2.8% in 2022 and 2.1% in 2023, but the economy is expected to grow faster by 2.1% in 2024.

President Lagarde stated during the Q&A session that they will not tolerate fragmentation that impedes the transmission of monetary policy. Following the ECB’s confirmation of rate hike plans, European stocks fell, while Euro was trading at $1.07.