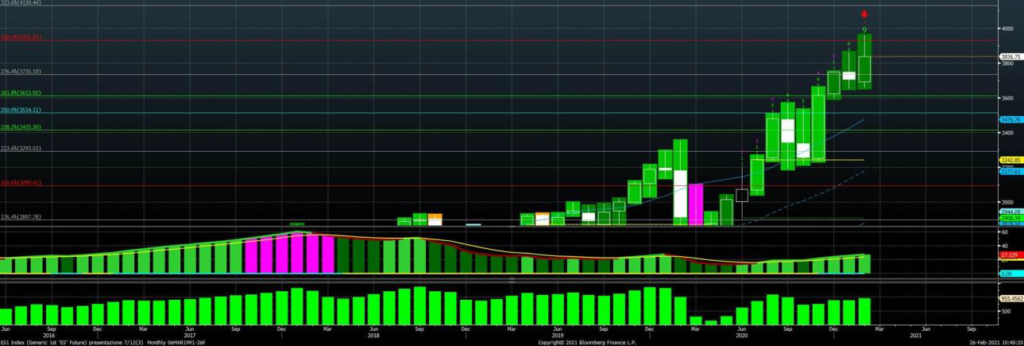

We talk today of Sp500 because the market touched this morning a very important first support:

3,790.

Our analysis tells us a possible rebound from this level. BUT IN CASE OF BREAKING with high volumes possible targets on downside will be:

3,720 and then more likely 3,660

Our trading system is 30 pct short with an increase of short with a DAILY closing below 3,780

On upside resistance at 3,950.

On the long term (monthly chart from 1995 to date) we stress that we had a “9” setup given from DEMARK model. Usually a correction phase happens after this signal. We can really test in the month of march the strength of the stock markets: if breaks on the upside 3,960 the stock market will go up for more months to come; otherwise a correction of at least 1-2 months will be likely down to 3,640 then 3,500.

THEREFORE ANY BREAKING OF THE LEVELS SIGNALLED ABOVE COULD BE A CONFIRMATION OF forthcoming MARKET WEAKNESS IN THE MEDIUM TERM.