The Fed’s tightening efforts take effect with inflation slowing for the eleventh consecutive month. According to the US Bureau of Labor Statistics, headline CPI eased to 4.0% year-over-year in May 2023, the lowest since March 2021. Core inflation fell to 5.3% in May, from 5.5% in April 2023.

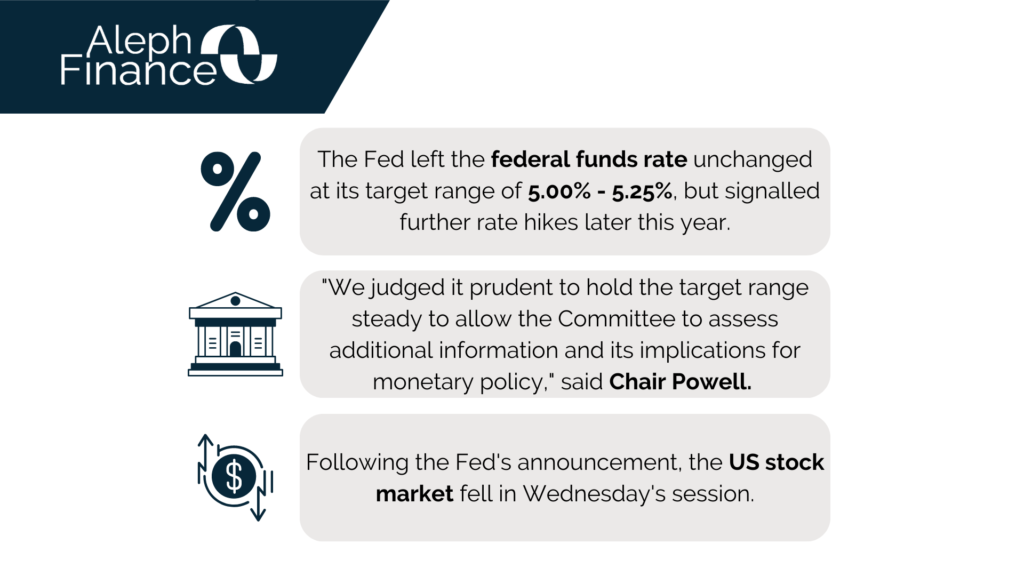

On Wednesday, the Federal Open Market Committee (FOMC) announced a pause in its aggressive monetary tightening campaign at its June 2023 meeting. The federal funds rate remained unchanged at a target range of 5.00% – 5.25%. This marked the first pause after ten consecutive rate hikes. “We judged it prudent to hold the target range steady to allow the Committee to assess additional information and its implications for monetary policy,” said Chair Powell during the press conference.

The FOMC also released its economic projections, signalling more rate increases this year. The “dot plot” showed that the members expect the rate to reach 5.6% at the end of this year, which is higher than the previous projection from March (5.1%). This suggests two more quarter-point increases in 2023. Rate projections for 2024 and 2025 were also revised upwards.

Core PCE inflation was revised upwards, expected to reach 3.9% in 2023 (from 3.6% March projection). Following the Federal Reserve’s announcement, US stocks fell in Wednesday’s session.