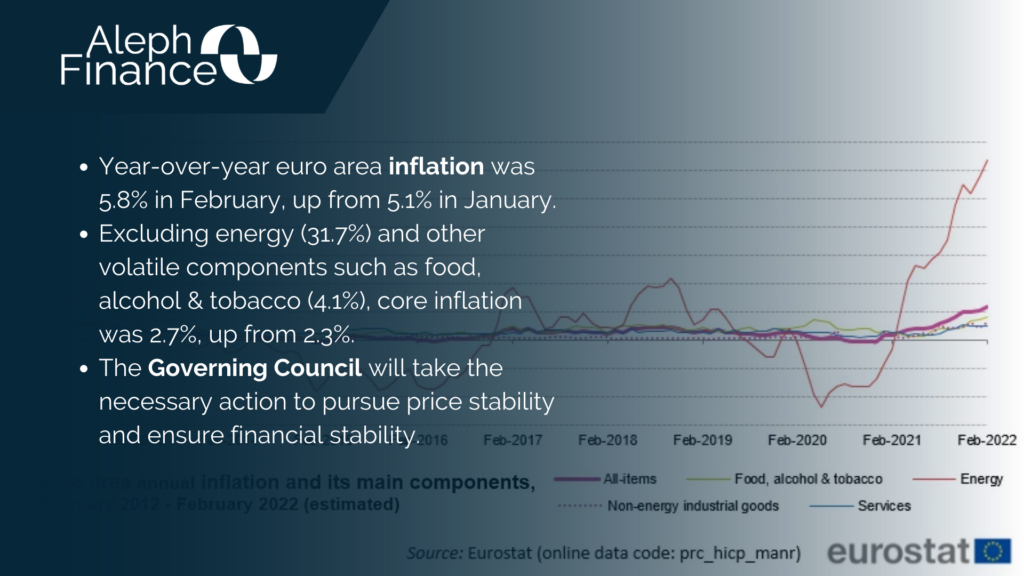

The Russia-Ukraine war has posed further challenges to the ECB’s tapering plan, putting President Lagarde in a difficult position, amid looming inflation and slow economic growth projections. February’s inflation rate in the euro area soared to 5.8%, with energy being the main driver at 31.7% increase. The figure is likely to rise even more as the war has made oil and gas prices skyrocket.

“A scenario close to stagflation is not out of the possibilities,” said Mario Centeno, a member of the ECB’s Governing Council, in an interview with Bloomberg on the 28th of February. Stagnant growth and increasing inflation will depend heavily on the course of the war, as supply disruptions and commodity prices are heightened even more.

The ECB maintained the interest rate unchanged at 0%, the marginal lending facility rate at 0.25% and the deposit facility rate at -0.5%. The central bank surprised the market by announcing a tapering acceleration of the asset purchase program (€40 billion in April, €30 billion in May and €20 billion in June), which may end in the third quarter. This decision can be revisited if the outlook changes. President Lagarde stated that any adjustments to the ECB interest rate will be gradual and will be determined with the strategic commitment to stabilize inflation at 2% over the medium term.