This week began with imminent geopolitical tension characterized by a warning of a possible Russian invasion of Ukraine, but on Tuesday news on the partial retreat of Russian troops to their bases appears to be a move that has the potential to ease tensions between Moscow and the West. Market reaction to the news was positive and the rouble rose 1.5% shortly after the announcement.

Inflation continues to be persistent and Central Banks are feeling the pressure. In terms of prices, the US PPI announced yesterday for the month of January remains strong at 9.7% year-over-year.

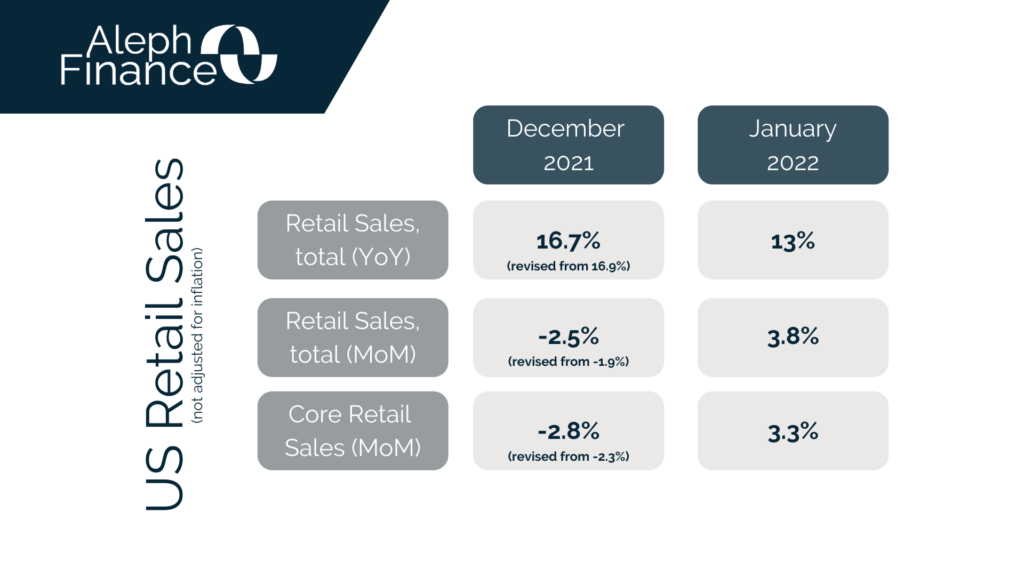

Today a major macroeconomic data to keep an eye on is US retail sales in January, which were expected to bounce back after positive wage hikes and a decline in Covid cases in the second half of the month. January retail sales data was up 3.8%, an increase from a 2.5% decline of December (revised from -1.9%), while year-over-year sales was 13%. Core retail sales, which excludes automobiles, was 3.3%, up from the previous -2.8% (revised from -2.3%). Food services and drinking places saw a decline of 0,9%. Gasoline stations are down 1.3%. Amid growing inflation and raising retail sales figures, the Fed is expected to raise interest rates the extent and degree of which is going to be the focus point on which market participants attention will be dragged on.