Following Wednesday’s higher-than-expected CPI data in the US, markets were considering the possibility of a full percentage point increase at the July Fed meeting. Some non-voting Fed members already expressed their view on this. Atlanta Fed President Bostic stated that “everything is in play”, while San Francisco Fed President Daly said a 100 basis point hike is “possible” but 75 basis point is more likely. On the other hand, some voting members, like Governor Waller and St. Louis Fed President Bullard said they support a 75 basis point increase at their next meeting. In particular, Waller said he is open to a larger hike depending on incoming data, such as today’s retail sales.

The Fed’s Beige Book was also released on Wednesday. It reported modest economic growth since the last report, with several districts noting a slowdown in demand and five districts voicing their concern over the increased possibility of a recession. The economic outlook for the future was mostly negative.

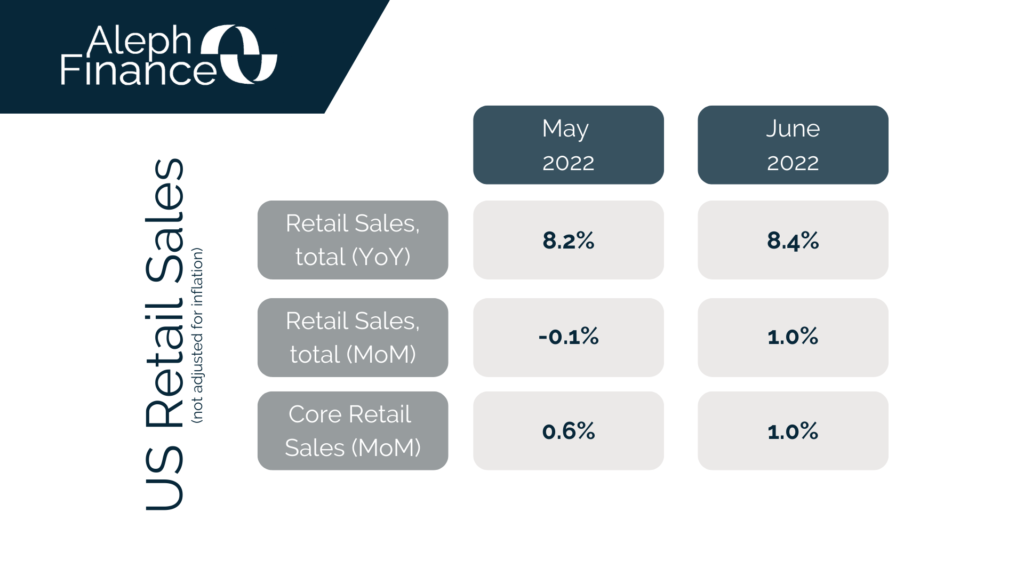

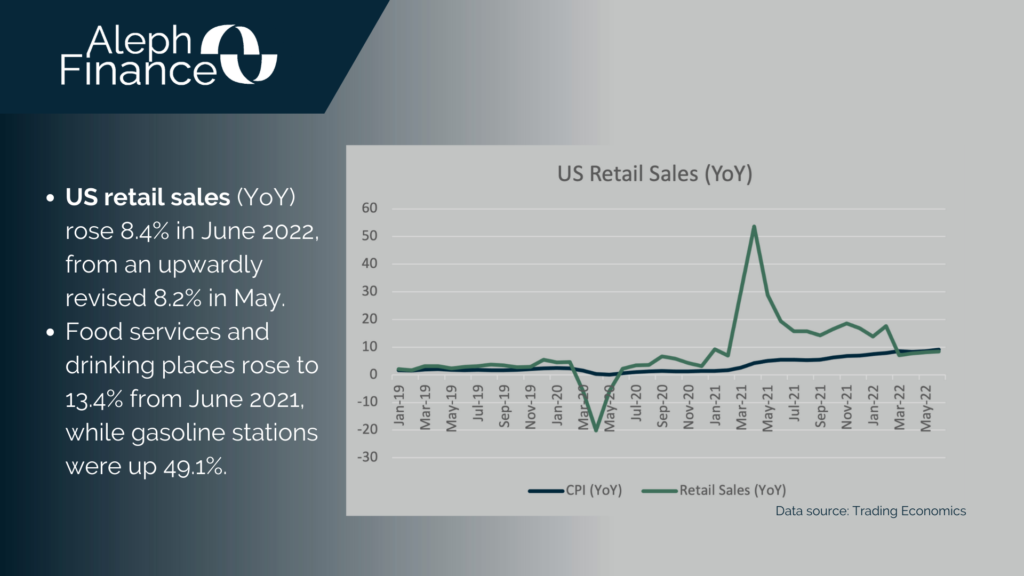

US retail sales in June 2022 was 1.0% month-over-month, from -0.1% in May and surpassing the market forecasts of 0.8%. Year-over year retail sales was 8.4% in June 2022, following an upwardly revised 8.2% the prior month. Core retail sales, which excludes automobiles, rose 1.0%. All eyes are now on the Fed’s upcoming monetary policy meeting.