Market fears appear to be proliferating in a highly uncertain environment. The main concerns relate to the impact of the Fed’s aggressive rate hikes on US growth, the energy crisis in the Euro area and the possibility of a new lockdown in China. In this context, the euro reached parity with the US dollar yesterday for the first time in 20 years.

Just recently China reopened and now new covid outbreaks are increasing the risks of a new lockdown. The impact on the economy of a new lockdown in China is sure to be painful as supply chain disruptions add to the already high inflation. In Europe, fears of a total cut in gas supply from Russia intensified as the Nord Stream 1 pipeline is undergoing maintenance, which started on Monday and is expected to end on July 21.

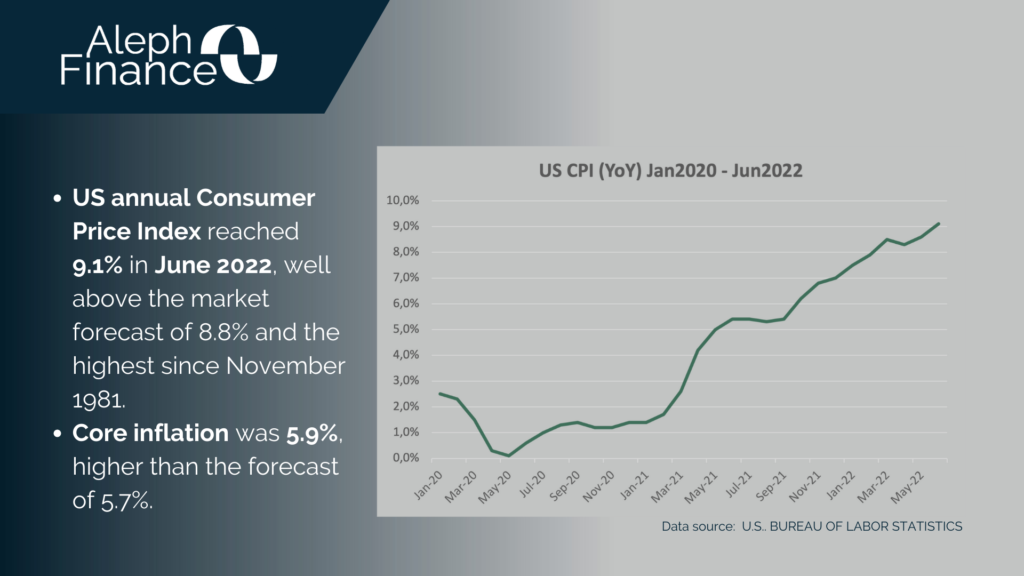

Recession fears still persist. The White House Press Secretary, Karine Jean-Pierre, said on Monday during a press briefing that they expect the headline inflation to be “highly elevated” in June. This statement further fuelled fears among operators. Strong labor market and high CPI data should confirm the Federal Reserve’s aggressive stance to fight inflation. In an interview with CNBC, Atlanta Fed President Bostic said he is in favour of a 75 basis point hike at the next meeting and that the economy will be able to absorb such increase.

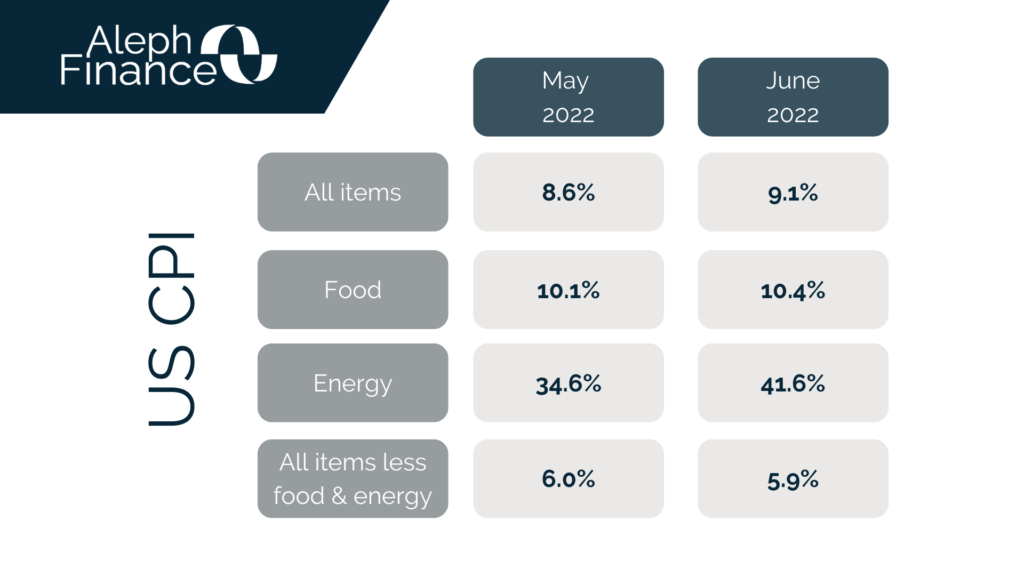

The US annual CPI hit 9.1% in June 2022, according to the US Bureau of Labor Statistics. The headline data is the highest since November 1981, surpassing 8.6% in May and the market forecast of 8.8%. Core CPI was 5.9% in June 2022, slightly below 6.0% in May but higher than the forecast of 5.7%. Volatile categories remained high with food prices at 10.4% and energy prices at 41.6%. Shortly after the release of higher-than-expected inflation data, stock futures fell.