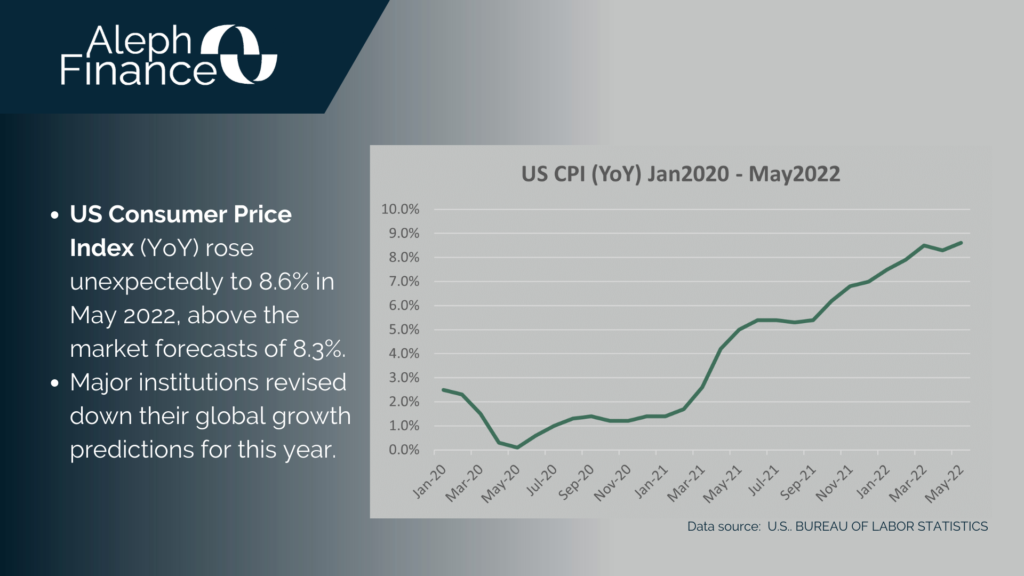

The focus is on the US Consumer Price Index. This inflation measure is highly watched by investors to assess the health of the US economy and to monitor if the Federal Reserve’s efforts to tame inflation by raising the interest rate are paying off.

Fear of stagflation is still in the picture as the World Bank warned of the risk of it on Tuesday, when it released its latest Global Economic Prospects and reported a global growth forecast of 2,9% in 2022, down from the 4.1% anticipated in January. Another major institution revised down its global growth prediction for this year. On Wednesday, the OECD said that global GDP is expected to be 3.02%, down from the December 2021 projection of 4.46%. The slowdown in growth is mainly attributed to the war in Ukraine, supply-chain disruptions and lockdowns in China.

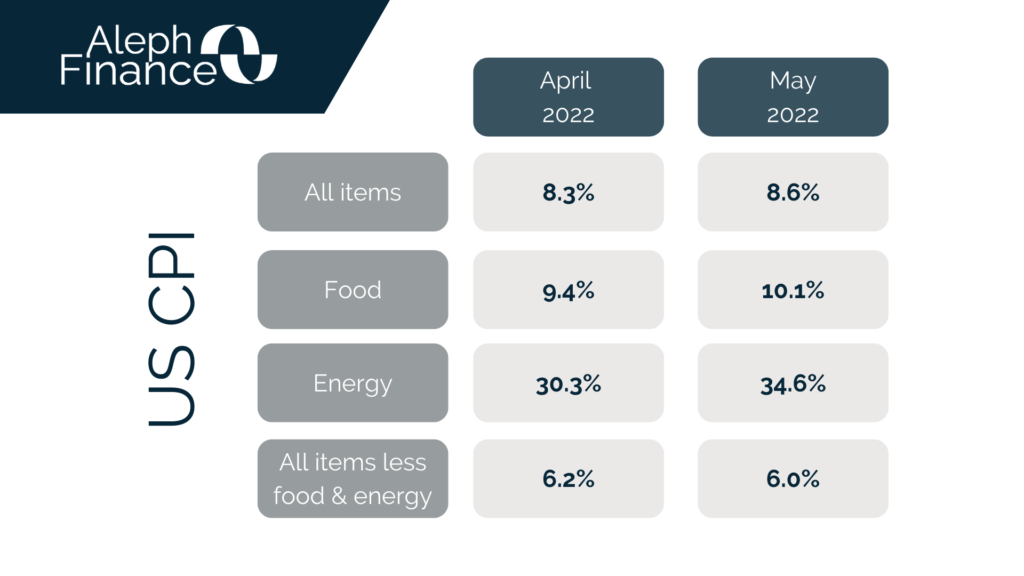

According to the US Bureau of Labor Statistics, the US CPI (YoY) was 8.6% in May 2022, the highest since December 1981 and above market forecasts of 8.3%. This unexpected figure confirms the monetary policy that the Federal Reserve has decided to pursue. Core CPI, which excludes the volatile food (10.1%) and energy (34.6%) categories, slowed to 6.0% in May 2022, from 6.2% in April but slightly higher than the forecast of 5.9%.

Following the report, US stock futures fell sharply in pre market-open trading, while the 2-year Treasury yield jumped above 2.9%. The market consensus is now that the FED will carry on with its hawkish stance at an even more aggressive pace.