The cost of living crisis in the UK is making itself felt more and more, and some experts have warned that recession could come sooner than expected. Recent data has shown a further weakening of the British economy.

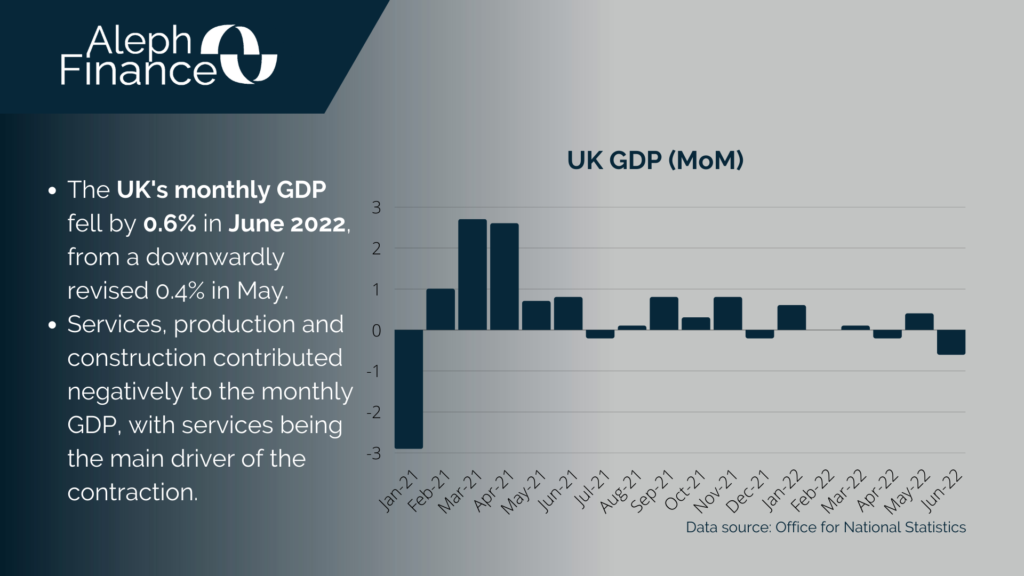

The Office for National Statistics (ONS) reported that the UK GDP is estimated to have shrunk by 0.1% (QoQ) in the second quarter of 2022, from an expansion of 0.8% in the first quarter. The monthly GDP’s first reading showed a contraction of 0.6% in June, from a downwardly revised growth of 0.4% in May. Services was the main driver of the contraction, with a sharp decline in human health and social work activities as coronavirus-related activities decreased further.

According to the ONS, regular pay (excluding bonuses) increased by 4.7% in April to June 2022, but taking into account inflation, it fell by an annual 3%. This drop is the biggest on record for regular pay, reflecting the decline in living standards and consumers’ purchasing power.

The Bank of England is raising interest rates in order to bring inflation down to its 2% target. At its August 2022 meeting, the central bank increased its bank rate by 50 basis points, the biggest hike since 1995. The sixth consecutive increase brings the current rate to 1.75%.

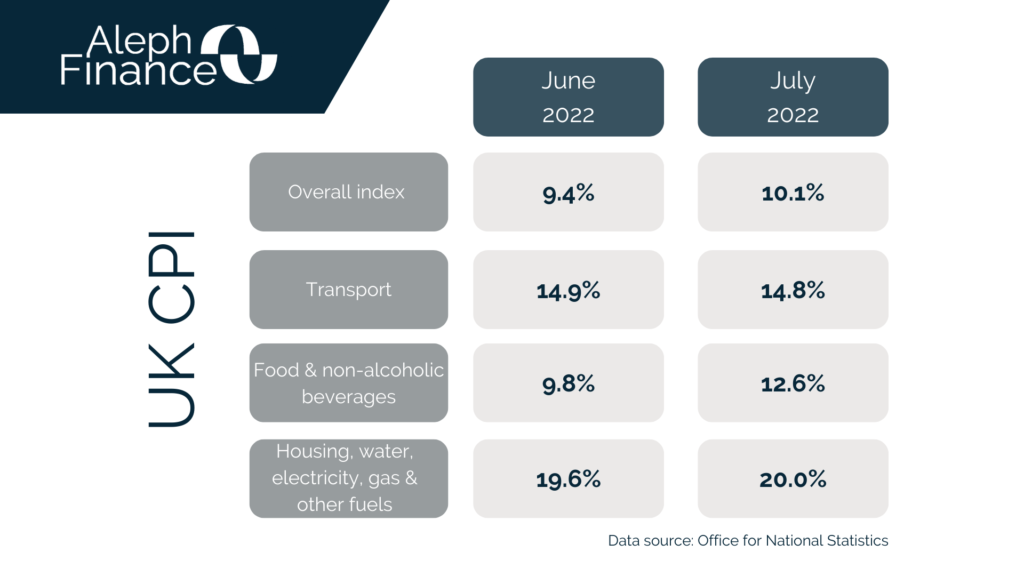

High prices continue to put a strain on households in the UK. The latest annual CPI released today by the ONS reached 10.1% in July 2022, up from 9.4% in June and above the market forecast of 9.8%. This is the highest figure since February 1982. Core CPI rose to 6.2%, from 5.8% in June. The main drivers of inflation were housing, water, electricity, gas & other fuels (20.0%), transport (14.8%) and food & non-alcoholic beverages (12.6%).