Inflation, supply chain disruptions and the Russia-Ukraine war continue to put pressure on the global economy and central bank monetary policy decisions. “We know that Russia’s invasion of Ukraine is creating significant economic uncertainty,” said UK’s Chancellor of the Exchequer Rishi Sunak.

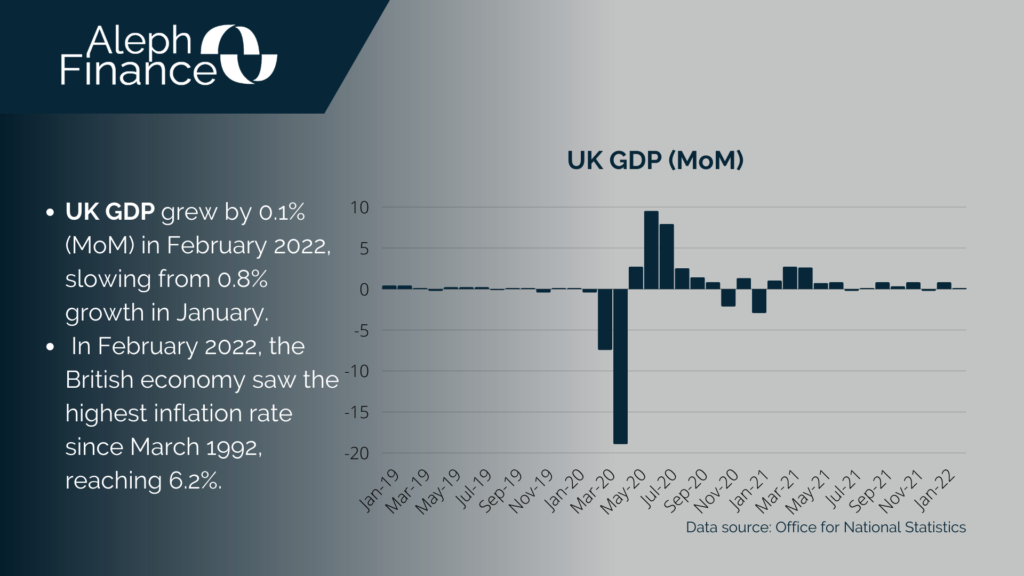

According to the Office for National Statistics, the UK economy slowed in February 2022, showing an expansion of just 0.1% month-over-month, down from 0.8% growth in January and below market forecasts of a 0.3% increase. The main contributor to February’s growth was services (0.2%), which was partially offset by a 0.6% drop in production and a 0.1% fall in construction. Tourism-related industries were the main driver of services growth. Monthly GDP in February 2022 was 1.5% higher than it was before the COVID-19 pandemic of February 2020.

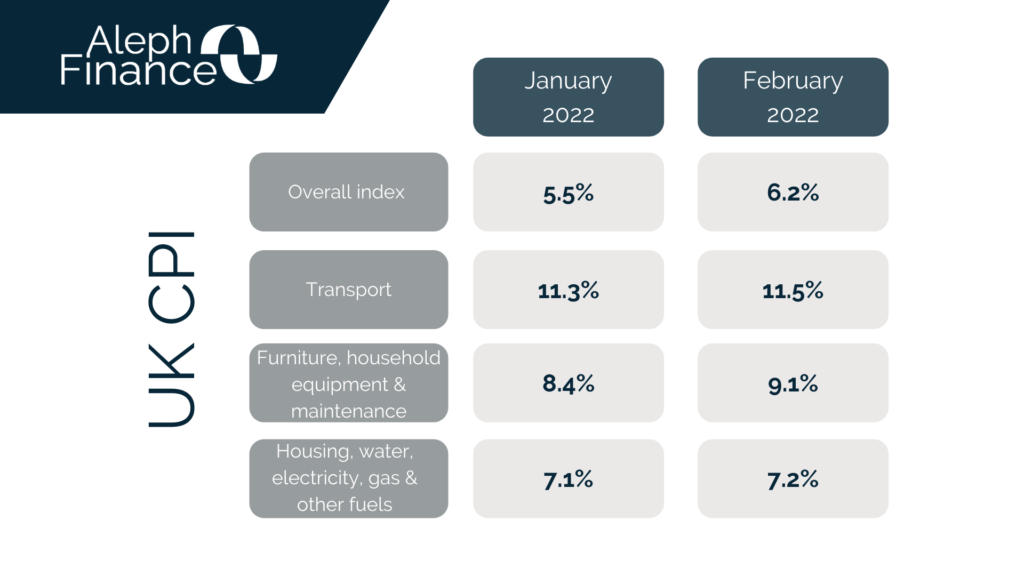

The rising cost of energy and food continues to put a strain on people’s living standards. In February 2022, the British economy saw the highest inflation rate since March 1992, reaching 6.2%.

The current Bank Rate issued by the Bank of England is 0.75%. After consecutive interest rate hikes, all eyes will be on the next announcement by the Monetary Policy Committee on May 5.