This week’s focus was on Fed Chair Powell’s testimony on monetary policy to the Congress and the US labor market data. On Tuesday, Chair Powell stated that “the ultimate level of interest rates is likely to be higher than previously anticipated”, altering how markets viewed the next rate increase and the terminal rate. Prior to Powell’s remarks, the CME FedWatch Tool was pricing in a 25bps hike at the next meeting in March, shifting after to 50 bps. A return to half a percentage point would mean an increase in pace from the previous three hikes, where it slowed from 75bps to 50bps and then to 25bps. Inflation remains well above the central bank’s 2% target. All eyes will be on the next release of CPI data on March 14, ahead of the FOMC meeting.

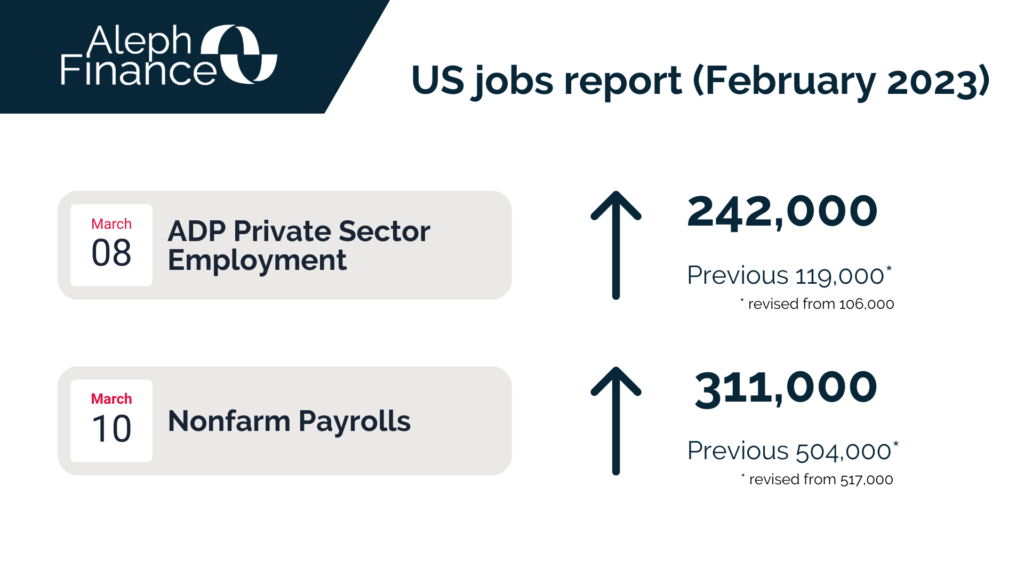

The latest US jobs report continued to show a strong labor market, despite high borrowing costs and consumer prices. On Wednesday, the ADP report showed that 242.000 private payrolls were added in February 2023, from un upwardly revised 119.000 in January and above market forecasts of 200.000.

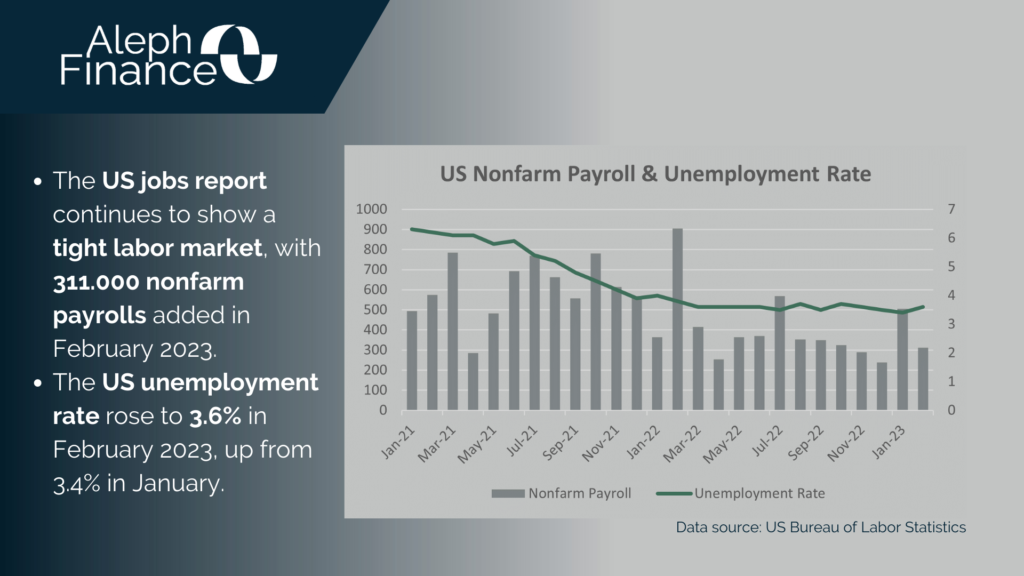

Today, the US Bureau of Labor Statistics reported that nonfarm payrolls unexpectedly increased by 311.000 in February 2023, well above market forecasts of 205.000. The US unemployment rate rose to 3.6% in February 2023, above market forecasts of 3.4%. Year-over-year average hourly earnings increased by 4.6%, slightly below market forecasts.